Friday, August 29, 2008

Constellation Energy Partners (CEP) is down another 40 cents at 13.60 and at that price is yielding a whopping 16+%. Either the market is telling us that this is the steal of a lifetime...or...the market is pricing in a distribution cut. I vote for the latter. Even though the company has already asked the board to approve a third quarter distribution at the same rate....the market isn't this inefficent or this stupid. It doesn't help that the parent company put its stake on the block yesterday at what will be firesale prices for them. They might as well cut the distribution and get it over with so we can send this down into the single digits.

You can tell i'm pissed off.

With Labor Day looming things are really slowing down but with Gustav a threat early next week to the oil and gas operations in the north central Gulf of Mexico, the energy markets will be active and they are up this morning so energy stocks and mlps will have a firm bid under them. This morning on the corporate front there is no news and nothing on the upgrade downgrade list.

MLPS have had a good week and we have apparently begun the slow process of repairing the damage of these past many months. I am going to keep things light on the blog side today. Of course i have said this before and have wound up doing a normal day. I will watch the first 30 or so minutes of the open and then maybe pick up a racing form for closing weekend in Saratoga.

Thursday, August 28, 2008

Martin Midstream(MMLP) is the big winner this afternoon back over 30 and up 1.58. Holly Partners (HEP)and EV Partners (EVEP) still lead the losers list but they have come off their lows of the day.

Bulls have the upper hand in here.

EV Partners (EVEP) is the biggest loser down 1 and some change. Some of the heavyweights are down like Kinder Morgan (KMP) Sunoco Logistics (SXL) and Enterprise (EPD). Meanwhile Buckeye (BPL) and Williams (WPZ) are fractionally higher with Williams looking at the 30 dollar level.

Was hoping for another day of solid upside but we are near the top of that base range so we'll see what happens this afternoon.

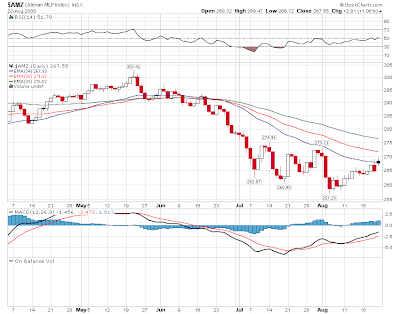

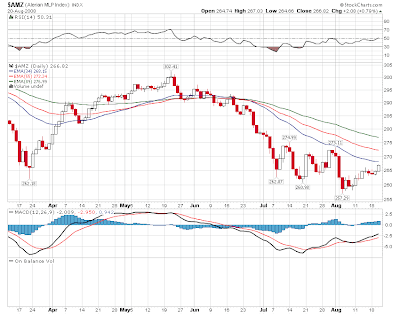

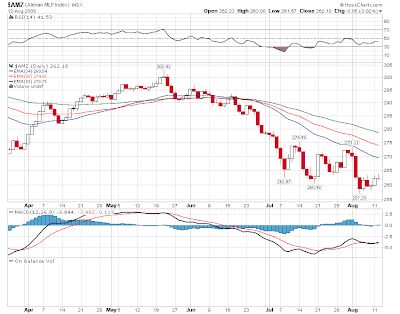

Yesterday's broad rally which took the MLP index 4 points higher and saw the devestated GP's wake up as well now has taken us to the top of the base where we will challenge 275 along with moving average headwinds.

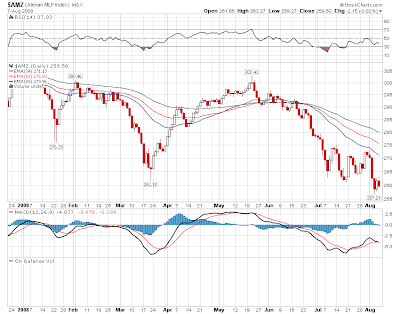

The weekly chart is pretty interesting since we came down and it appears successfully tested the 200 week moving average (that's almost 4 years kids!) and we need now to put some distance between that and the current level @ 271 and some change. The weekly chart last went to a buy in March and that led to a reflex rally. I think this time we could be at the beginning of something that has longer term implications.

The weekly chart is pretty interesting since we came down and it appears successfully tested the 200 week moving average (that's almost 4 years kids!) and we need now to put some distance between that and the current level @ 271 and some change. The weekly chart last went to a buy in March and that led to a reflex rally. I think this time we could be at the beginning of something that has longer term implications. What was really encouraging about yesterday's action to me is that MLPS outperformed everything which is a huge sea change from prior trading action. Now i know it was only one day so i am looking for follow through action today to confirm. But this stuff is so underowned that we could have room to run perhaps as high as 280 or so in a hurry. But 275 is the first headwind and if we are in a basing period it could turn us back down to do more work.

What was really encouraging about yesterday's action to me is that MLPS outperformed everything which is a huge sea change from prior trading action. Now i know it was only one day so i am looking for follow through action today to confirm. But this stuff is so underowned that we could have room to run perhaps as high as 280 or so in a hurry. But 275 is the first headwind and if we are in a basing period it could turn us back down to do more work.

Some chatter on the Constellation Energy Partners (CEP) message board that the parent Constellation Energy (CEG) was either planning another asset dropdown or might be preparing to unload its 50% stake in the company. The company had an anal-ist day yesterday and apparently hinted at this. Since the company stock price has gone from 50 to 15 i can't imagine anything could make things worse. Now we have this breaking news item about the parent selling its gas assets. Does that mean that Constellation is going to sell its stake or are they talking about other assets? Anyone have clues here?

No news this morning and no upgrades or downgrades. Crude is higher and so is natgas as Gustav concerns continue. All the latest info from The National Hurricane Center. Stock futures are flat this morning ahead of GDP @ 8:30AM. Overall tape had a firm tone to it yesterday so i would expect that to continue today barring a disaster on the GDP. There were a few laggards among MLPS yesterday and i would expect those issues to take to the front today if this rally has legs.

And i posted another poll last night in view of yesterday's action. The first poll from last week results show the bullish bias that you would expect. 63% of you thought we'd be 280 or higher (combining the bullish choices) while 19% (combine bearish choices) thought we'd be 280 or lower. 19% of you said we'd be at around the same place by year end (265ish). We'll do this again in a month or so to see how sentiment has changed.

Wednesday, August 27, 2008

Exterran Partners (EXLP) is down 1.50 on no news and not much volume either. Not sure if anything is going on with this one. Inergy Holdings (NRGP) is down 60 cents..no news and no volume there. Otherwise losers are few and often times on a day like today they make their gains in the last 2 hours.

Looks like money is coming in.

The forecast takes Gustav right toward rig land and as a major hurricane so nat gas is reacting accordingly by rising another 50 cents this morning adding to yesterday's gain of 50 cents.. Oil is up 2 dollars. So weather is the catylist behind what should be a higher open for energy stocks and mlps.

Meanwhile we are still basing and we saw a near 1 point gain yesterday. And that process continues as we are challenging the moving averages that sit just above us.

One of yesterday's bigger gainers was Copano (CPNO) which has been one of the mlps that has held up a little better than others. The chart looks "bottomy" or bottom-ish so you can add it to the list of mlps that have at least put in some sort of a floor.

No corporate news this morning and no upgrades or downgrades. If we have indeed bottomed we are due to have a day where we are up substantially and across the board for MLPS. A 1-2% gain and a trip to 275 will be a sign that we are on a (slow) road to recovery.

Tuesday, August 26, 2008

Atlas Resource (ATN) and E V Partners (EVEP) lead the way up 1 and some change. Fractional gains in Buckeye (BPL)which is back over 42 and Williams (WPZ) which is trading over 29 bucks. Pretty long list of fractional gainers as well.

Losers are contained. Alliance Resource (ARLP) is down 70 cents as the biggest loser. Inergy Holdings (NRGP) is down 40 cents but not much volume there. Otherwise most losers today only off small fractions.

Okay that's a bit of a broad statement but clearly some MLPS have made some sort of a bottom. The overall index continues to form some sort of base in here bordered by 258ish @ the bottom and 275 ish @ the top. Now please bare in mind if the world completely falls apart that bottom may be suspect. But if it comes out it will be in conditions where everything else gets really taken out and shot.

The "V" shaped bottom got us only bear market rallies in the past which has led to lower lows. The "W" bottom is more complex and in my view has more value. Buckeye Partners (BPL) has rallied nicely off its "W" bottom.

The "V" shaped bottom got us only bear market rallies in the past which has led to lower lows. The "W" bottom is more complex and in my view has more value. Buckeye Partners (BPL) has rallied nicely off its "W" bottom. Oneok LP (OKS) has actually gapped up above its downtrending moving averages which is a very bullish sign in here. The next step is for those averages to turn to a positive slope and have the stock price pullback in for a support test. Note the last time that happened a few months ago led to failure.

Oneok LP (OKS) has actually gapped up above its downtrending moving averages which is a very bullish sign in here. The next step is for those averages to turn to a positive slope and have the stock price pullback in for a support test. Note the last time that happened a few months ago led to failure.

This morning we have 2 factors at play as crude oil is down but well off its lows. Its responding to a stronger dollar. Natural Gas meanwhile is up 20 cents as it reacts to Hurricane Gustav

The National Hurricane Center forecast takes this into the Gulf Of Mexico as a Category 3 100 knot major hurricane. This path would put it on a direct collision course to where the vast majority of gulf rigs and nat gas lines are located. But often times the market figures this out ahead of time...rallies on the idea that the entire Gulf of Mexico gets wiped out...and then sells off when ultimately the damage is no where near what was forecast. A few months ago during the crude oil mania we'd be seeing a 10 dollar up day on crude. Instead the global slowdown and the rallying dollar has become the dominating market factor. All news now gets spun bearishly.

This morning we have no corporate developemets to speak of and no upgrades or downgrades. Market volume has been almost non existent and i would expect more of the same vacation week volume today. Yesterday's performance by the group was not bad considering a 2% decline of the overall tape and a sell off again in bigger energy stocks.

Monday, August 25, 2008

i'll wait for the finish but if we close with less than a 1 point loss i think it puts some confidence in my view that we are building a base from which a nice rally could develope come the fall.

just my lil ole southern humble opinion (of course!)

Good riddance frankly. But we at least have been in mending mode since the beginning of August. Now candlestick followers please note that there was an error in the chart for thursday which was an up day and friday which was a down day so this chart is not what it appears. But this is what we have to work with. I'm still learning this but that looks like an evening star formation on Friday which would be bearish...but again the chart is in error here.

Also please please please if you haven't already and vote only once please scroll down to the prior post and take the poll i've set up so we can get a measure of sentiment.

Nothing is going on in MLP land this morning, no news, no upgrades or downgrades. Crude is bouncing a bit after last Friday's collapse so there should be an up open in MLP land. Nat gas is a little higher as well.

Okay...let er roll on this Monday and a new adventure begins.

Friday, August 22, 2008

These past many months getting to Friday has been a relief because on the weekends we can't lose money. Well for a change this week we have enjoyed some upside. So everyone's portfolios should be a little bit fatter this week. A few points. Many posts in the comments section which i love and enjoy. And there is always room for more. Secondly lots of posts from Williams (WPZ) holders. In case you guys missed it i posted last night that a nearly 2 million share block of Williams shares was crossed yesterday at 25.75. So maybe that is the last of whoever was selling shares these past many days. Also there has been some weakness from time to time during the day along with skepticism. I view that as bullish. If we were running straight up it would just be more of the same tape action. The action this week in terms of the tone of trading has changed. Now if the overall market can behave itself then maybe we are really building a base here to launch something more substantial in the fall.

Crude is off a little this morning after yesterday's rally. Stock futures were lower but have suddenly taken off led by financials. Nat gas is a little lower and the dollar higher.

Thursday, August 21, 2008

Back over 268 on the mlp index and we are up close to 1.50.

Natural Resource Partners(NRP) leads the winners list up 1 and some change. Coal mlps are fractionally higher. Targa (NGLS) is up 44 cents on the Citigroup upgrade. Buckeye (BPL) Atlas Pipeline (APL) Teppco (TPP) and Energy Transfer Partners (ETP) among the fractional gainers.

One clear outperformer through all of this has been Markwest Energy (MWE)

Its been no worse than sideways with the occasional spike dow, and those spikes down have been good entry points. If we are on the road to recovery Markwest should be among the first to breakout. That would mean a close above 38.

Its been no worse than sideways with the occasional spike dow, and those spikes down have been good entry points. If we are on the road to recovery Markwest should be among the first to breakout. That would mean a close above 38.

The mlp index did well yesterday with a nice 2 point gain and our little base is holding nicely. Respect the "doji hammer" is the battle cry and we have seen a very short term trend change since the hammer appeared nearly 2 weeks ago. We are about to challenge the 34 day moving average which is in decline of course and that sits just above where we are right now. The top of the base remains 275 so we have some challenges ahead. Copano (CPNO) has been a sideways performer in this mess with a bit of a downward bias. We may be in a bottoming area in here for this one as well.

Copano (CPNO) has been a sideways performer in this mess with a bit of a downward bias. We may be in a bottoming area in here for this one as well. Energy stocks continue to have a tailwind this morning with the trendline rally in crude continuing this morning; up 1.50 as of this post. Nat gas is higher by a few pennies as well.

Energy stocks continue to have a tailwind this morning with the trendline rally in crude continuing this morning; up 1.50 as of this post. Nat gas is higher by a few pennies as well.

Many of you have been wondering why all the selling in Targa Resources(NGLS) lately coupled with heavy insider buying. We haven't resolved the mystery of who the seller is but Citigroup is upgrading the stock to a buy from a hold this morning and setting a 27 dollar target.

Nothing else happening this morning so lets see if we can make it 3 up days in a row.

Wednesday, August 20, 2008

Atlas Resource (ATN) Alliance Resource (ARLP) and Plains All American (PAA) showing 1 point plus gains.

Penn Virginia Holdings (PVG) is down nearly 2 points...no news there.

Markwest (MWE) Sunoco Logisitcs (SXL) and E V Partners (EVEP) lead the way higher up 75 cents or better on all three though off their highs. Targa (NGLS) Suburban Propane (SPH) and Penn Virginia Holdings (PVG) showing losses of 75 cents or worse. So 75 cents is the theme at lunchtime.

Would be nice if we could build on this during the afternoon but as always caution is advised in these sad times we endure!

Before i get to some individual charts i just want to touch on the MLP index which continues to show some nice basing action in here. Now remember we could go back down to below 260 and still be okay...though we rather not take that adventure again....and 275 would be the upside top to get through...and that could takes us awhile should we get there. Base building is a long frustrating process which pisses everyone off until the breakout comes.

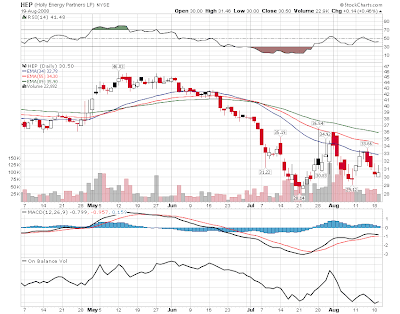

Before i get to some individual charts i just want to touch on the MLP index which continues to show some nice basing action in here. Now remember we could go back down to below 260 and still be okay...though we rather not take that adventure again....and 275 would be the upside top to get through...and that could takes us awhile should we get there. Base building is a long frustrating process which pisses everyone off until the breakout comes. Meanwhile i was poking around a few mlp charts yesterday and noticed some nice double bottoms are forming in some of these like Holly Partners (HEP) which has been decimated as much as everyone else and has done nothing wrong along the way. Eagle Rock Energy Partners (EROC) is another one in here that looks like a double bottom is forming. Buckeye Partners (BPL) above tends to follow the mlp index and there is a "w" formation there which you can find on the chartsin other places. That has led to trading rallies before.

Meanwhile i was poking around a few mlp charts yesterday and noticed some nice double bottoms are forming in some of these like Holly Partners (HEP) which has been decimated as much as everyone else and has done nothing wrong along the way. Eagle Rock Energy Partners (EROC) is another one in here that looks like a double bottom is forming. Buckeye Partners (BPL) above tends to follow the mlp index and there is a "w" formation there which you can find on the chartsin other places. That has led to trading rallies before.

Linn Energy (LINE) has come off its double bottom from the spring and peeked under 20 briefly in this last downturn but is now back above 20 and looks like it wants to rally.

Linn Energy (LINE) has come off its double bottom from the spring and peeked under 20 briefly in this last downturn but is now back above 20 and looks like it wants to rally. Also on balanced volume on Linn which is a running total of up volume minus down volume is no where near its spring lows. Ultimately here we are searching for "the" bottom and not another trading rally bottom. And of course any rally will have to prove itself ultimately and the first test will be the moving average resistence which is sitting above current levels.

Also on balanced volume on Linn which is a running total of up volume minus down volume is no where near its spring lows. Ultimately here we are searching for "the" bottom and not another trading rally bottom. And of course any rally will have to prove itself ultimately and the first test will be the moving average resistence which is sitting above current levels.

Newswise its quiet this morning. We have tailwinds with stock futures and energy futures higher. Inventory numbers at 10:30am will drive crude. No upgrades or downgrades.

Tuesday, August 19, 2008

Targa Resources (NGLS) as many of you have pointed out was hit hard this morning by somebody but the loss is cut to 30 cents right now. EV Partners (EVEP) and Penn Virginia Holdings (PVG) are down major fractions as the 2 biggest losers.

Buckeye Holdings (BGH) is actually up a few pennies inspite of the Merrill downgrade. Holly (HEP) Alliance (ARLP) and Natural Resource (ARLP) showing 1 point-ish gains. Eagle Rock (EROC) up 30 cents right now on getting its credit line expanded.

Well its better than being clobbered.

Crude oil continues to straddle just above its 200 day moving average so i expect a trendline rally of some sort to develope there...maybe enough to give energy stocks a tail wind after the open...imho of course.

I like down opens much better than up opens in a downtrend like this because it sets up for a reversal that could hold for awhile. Sometimes its wishful thinking. But MLPS seemed to be settling down in here in the low 260's so we appear to be basing. Of course if the entire stock market falls out of bed then look for a trip down to the bottom of the range.

Another sign that we could be bottoming out in here in mlps...anal-ists are falling all over themselves to downgrade these stocks or lower their targets now that they've missed the fall. Merrill Lynch downgrades Buckeye Holdings (BGH) to neutral from buy now that its gone from 30 to 18. And Citigroup keeps DCP Midstream (DPM) at a hold but lowers its price target. RBC is upgrading Cheniere Energy (LNG) to neutral from underperform.

Not much else happening this morning. PPI was awful but like CPI it could be baked in already. We'll see.

Monday, August 18, 2008

Very boring afternoon trading here. You could hear a pin drop.

Exterran (EXLP) and Hiland (HLND) lead the losers down 1.50 apiece although the volume is very low and a few buy on either one takes them up to the flat line in a hurry. Holly Partners (HEP) is down 1.

While i post the MLP index is suddenly up over 1 point. Kinder Morgan (KMP) just went fractionally higher and that could be the reason.

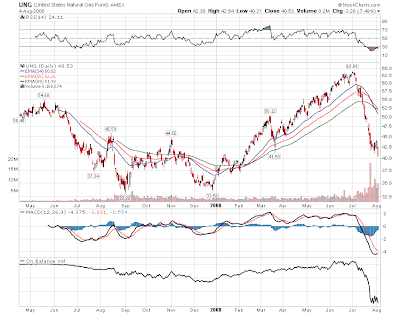

Also i think we are at a point now where a trendline rally for crude oil is in order. Nat gas this morning is down another 20 cents as it continues in absolute freefall from 13 dollars. Amazing that its almost straight down 40% for this commodity.

Also i think we are at a point now where a trendline rally for crude oil is in order. Nat gas this morning is down another 20 cents as it continues in absolute freefall from 13 dollars. Amazing that its almost straight down 40% for this commodity.

In corporate developements this morning we have 2 mlps and a priviate group forming a pipeline joint venture. Other than that we have nothing else happening as we are through the bulk of earnings and distribution checks for the most part have been posted and cashed. No upgrades or downgrades on the list so far.

Tropical Storm Fay is a non issue as it will head up western Fla at worst so no gulf rig threat there imho. Crude was higher but has turned lower as i post joining nat gas which is down 20 cents.

Saturday, August 16, 2008

Friday, August 15, 2008

We dropped to 263.28 as big energy pulls everything down thanks to another 3 dollar loss in Crude. But the index is now hovering near 264. Not too bad considering.

Its where we finish today thats most important.

Crude on the USO got to the 200 day moving average. Logical place for a short covering rally to get underway.

Its a Friday in August so i would expect slow trading today but stock futures are stronger. Crude and the rest of energy is lower. The dollar continues its massive rally. Gold is imploding. The question again today will be if mlps diverge from bigger energy stocks that will start off lower. No upgrades or downgrades.

Thursday, August 14, 2008

Some volume in Inergy Holdings (NRGP) which usually trades by appointment only. 6500 shares traded with the stock down 36 cents. No news there but somebody is moving some stock around and perhaps accumulating. I'm long this one so i'm hoping for a pop up.

Crude off the lows down 1.50. Nat gas is looking hopeless in here. Dollar rally continues. Dow up 120.

Watch the afternoon trading...If mlps move back higher it will confirm the idea that we could be in a base building phase.

Or maybe freebasing...i don't know. The chart looks that way or maybe its the medication. Still basing is a process and a long and frustrating one at that getting bulls and bears pissed off. Sometimes it looks like a breakout and it doesn't...or it looks like a breakdown...and it doesn't. Still the chart has taken on a bit of different look here as it evolves. I think you draw a line around 260 and another line at 275 and thats the channel we are in and likely to stay in for a bit.

I've put charts of the Nasdaq Composite up this morning. Interesting that those charts look like they have put in complex "W" shaped bottoms and in fact the nasdaq is close to breaking out of the top of that formation.

I've put charts of the Nasdaq Composite up this morning. Interesting that those charts look like they have put in complex "W" shaped bottoms and in fact the nasdaq is close to breaking out of the top of that formation. These 2 charts could be signalling that the broader market has bottomed and MLPS might be able to get pulled along a small stock rally if it begins to gather steam. Something to watch.

These 2 charts could be signalling that the broader market has bottomed and MLPS might be able to get pulled along a small stock rally if it begins to gather steam. Something to watch.

Yesterday was a nice day in MLP land with a 2+ point gain and we start the morning near 265 and it looks like an up open right now with stock futures stronger and energy markets flat to a little higher. No corporate developements and no upgrades or downgrades on the list at least so far.

Check back to last nights posts as there were more insider open market purchases in a few issues. Lots of insiders have been stepping up to the plate in the last 2 weeks....more so than at any other time in the last few years. With yield spreads at 700 basis points and @ an all time high...are insiders signalling that enough is enough? We always try to put the face of hope in the forefront.

Its all about jobless claims and CPI so lets see if they behave themselves...and if they do we could see some more plus signs in MLP land.

Wednesday, August 13, 2008

Energy Transfer Partners (ETP) was the days big winner up over 1 point.

More insider buys today at Williams Partners (WPZ), DCP Midstream (DPM) with two insiders buying there...1000 shares and 2000 shares; and Martin Midstream Partners (MMLP). So we continue to see insider buying at an unprecedented pace. Certainly these are among the biggest insider buys in 3 years. Can't be bearish if they are using their own money and making open market purchases.

I liked the action on the mlp tape today as it was methodical..opened higher..pulled back...and then moved higher this afternoon into the close. And the gain was not too big to suggest it would be nothing more than a dead cat bounce. Looks like we could be at the beginnings of some base building in here.

I brought this up yesterday.

274 would be the top of the channel if we are indeed basing and 260 ish looks like the bottom...that is if we are basing. All these things are known in hindsight of course.

Read this post in the comments section. Puts things in perspective a bit about whats going on.

Hiland Partners (HLND) is kept at sector perform by RBC Captial markets but they raise their target price from 66 to 67. Odd in this enviornment. Crude and nat gas are up. No other corporate developements.

Tuesday, August 12, 2008

Also Legacy Partners (LGCY)...4000 shares. Insiders at MLPS are becoming more aggressive in their open market purchases. Atlas Pipeline had an 11,000 share insider purchase this morning and Buckeye Partners (BPL) late last week saw buying by insiders with both hands.

Means nothing of course but one never knows.

Markwest (MWE) is got an 88 cent gain out its earnings. But wait the day ain't over yet. E V Partners (EVEP) is losing 88 cents on its earnings and recommended distribution boost to 3 dollars annual and a 12% yield. More glory and praise!

MLP index is up fractionally but its up more than everything else in MLP land. DCP Midstream is down another 1 and change as it continues to react on the Merrill downgrade from yesterday. Constellation (CEP) is down 50 cents as it is still reeling from its 3 downgrades. Hiland (HLND) down 1.28 with no news there. Inergy (NRGY) is buying US Salt which is probably to be sold to MLP users who need something to rub into their open wounds. The stock is up 49 cents.

Merrill Lynch yesterday downgraded DCP Midstream (DPM). Constellation Energy Partners (CEP) has seen the three houses that have opinions downgrade it in the last few days. These downgrades are coming at or near 52 week lows which is a good place to do it. Is it a sign of capitulation? Who knows. I've thrown my hands up a long time ago. E V Partners (EVEP) should give holders another reason to sell this morning as the post earnings that after you cut through the hedges were excellent, announce 200 million in aquisitions, raising guidance, and they are going to raise the distribution to 75 cents from 70 cents bringing it to 3 dollars annual and a yield of 11.7%. Markwest (MWE) should have sellers waiting for it too as it announces spectacular earnings and increases guidance.

The MLP index yesterday finished with a 2 point plus gain which happened in the face of fallinf energy and falling energy stocks so the divergence was nice. Today is a new day however and we have falling crude again so look for big energy stocks to start the day under pressure. Nat gas is a little higher however. Stock futures have been improving all morning so the broader market will provide support. The dollar continues to rally strongly as the Euro has gone from 1.60 to 1.48 in a hurry. No help from that end.

About the only positive thing at this point is by the time the distribution checks come on Friday you probably can average in at 15% yields. Glory!

Monday, August 11, 2008

BTW i much prefer a day like today instead of another one of these big spikes up that get sold off within a day or 2. A long period of base building is in order. So a modest up close on the index would be a bigger positive in my never to be humble opinion.

Constellation Energy Partners (CEP) is down 1 on the downgrade by Citigroup. Hiland (HLND) is down 1. So is DCP Midstream (DPM). Dorcester Minerals, Natural Resource, Alliance Resource (ARLP) all taking about 1 point of gas.

Dow is rallying but its out of energy and into what wasn't working before like financials. Blah Blah Blah.

I'm a novice when it comes to candlestick charts but that hammer formation on the chart that occured Friday could be signalling a trend change. We tend to lag overall trends when they begin or end so it probably makes some sense that if the overall market is in some sort of short term rally mode we will begin to play some catch-up so i'm guardedly optimistic on an MLP rally today.

I would like to see some basing action develope on the chart but you don't always get what you want.

I would like to see some basing action develope on the chart but you don't always get what you want.

Some upgrade/downgrade action this morning as Wachovia is upgrading Williams Partners (WPZ) to outperform from market perform. Citigroup downgrades Constellation Energy Partners (CEP) to hold from buy. All three houses with opinions on CEP have now downgraded so there is no one left to downgrade.

Earnings this morning from Regency Partners (RGNC) which have all kinds of distortions in them due to asset purchases etc. Earnings are due today from Inergy LP (NRGY), Markwest (MWE) E V Partners (EVEP) and Energy Transfer Partners (ETP) and i'll post the links as they announce.

Euro got to 1.49ish overnight...around 1.50 this morning as the dollar continues to get attention. Crude is up 1.25 this morning and so is nat gas after another selloff last week. Stock futures are a little weaker but not by much. Looks like energy stocks should have a firm open this morning so lets get this new week underway.

Friday, August 08, 2008

At least the weekend is getting near..can't lose money on a weekend.

Big energy is getting clobbered. Mlps not so much. With the dollar now screaming higher i would think at some point 10% +yields in dollar denominated assets would become attractive. But i'm just a lowly mlp trader.

All through this decline we have seen "v" shaped bounces as you can see on this short term chart. No "v" shape bounce occuring here .....which may actually be a good thing. What we need to see in my opinion is a long period of base building. Perhaps that is what we are seeing the beginnings of here and yes i'm being hopeful. Of course we could be building another ledge from which MLPS dive off from.

Emerging from its base is the dollar which is screaming higher this morning some 2 cents against the Euro and we have commmodities down across the board. Stock futures are higher this morning. Anyway its food for thought among the rubble.

Earnings out this morning from Crosstex Energy LP (XTEX) which has been doing well on an earnings standpoint which hasn't translated. Hiland Holdings and Hiland Partners (HPGP,HLND) posted earnings numbers last night and announces an expansion. DCP Midstream (DPM) puts up excellent earnings. Blah Blah Blah Blah Blah!

Crude oil down 2.50 this morning and Nat gas continues in free fall collapse so look for pressure on broad energy stocks. Stock futures are up. We have another insider buy in Calumet Specialty Products (CLMT) which stands to benefit from falling oil prices.

So lets get another agonizing week over with. Sometimes it think the action feels just like this.

Thursday, August 07, 2008

Wachovia cut Constellation Partners (CEP) to a hold at 12:30pm...Lehman reiterates outperform on Exterran Partners (EXLP).

I aim small. We've had the occasional back to back up days but you have to go back to May and early June to find 3 up days in a row. Chart is hideous. But the tailwinds this morning are rising energy and the headwinds are the falling market. So we know which one we'll follow today.

Earnings news this morning from Constellation Partners (CEP) which says they will keep the distribution the same and guide to the low end of the guidance range. Stock is actually bid up in the pre market. Copano (CPNO) which i always like to think of it as that italian gas company in Texas reported earnings last night. They look pretty good and same for Plains All American (PAA). Linn Energy (LINE) which are never simple must be okay because the stock is trading up in the pre market. Record results and a 13 cent beat.

Earnings news this morning from Constellation Partners (CEP) which says they will keep the distribution the same and guide to the low end of the guidance range. Stock is actually bid up in the pre market. Copano (CPNO) which i always like to think of it as that italian gas company in Texas reported earnings last night. They look pretty good and same for Plains All American (PAA). Linn Energy (LINE) which are never simple must be okay because the stock is trading up in the pre market. Record results and a 13 cent beat.

Also this morning we have the Williams twins (WMZ,WPZ), Penn Virginia Holdings (PVG). Spectra Energy Partners (SEP), Suburban Propane (SPH) and Global Partners (GLP).

No upgrades or downgrades. The open and the day await us. Glory!

Wednesday, August 06, 2008

Oneok LP (OKS) Penn Virginia Holdings (PVG) and Copano (CPNO) are up 1 and change and lead the winners list. Fractional gains in a host of issues.

Tuesday, August 05, 2008

We can only hope and pray! And i'm not kidding here. As a practicing catholic i've said a novena and lit a few candles over this! Mr Cramer has pointed out all the damage in commodities related stocks which have just been in free fall and a few of you have posted

those comments here and they pretty much explain it all. Its the same thing that happened last August. When those quant funds sell they do so blindly. So its down until they stop going down. I know that sounds a bit simplistic but when stuff isn't working...it just isn't working!

This morning we have earnings from Exterran Partners (EXLP) along with some management changes. Also we have earnings this morning from Holly Partners (HEP) and Quicksilver Gas Services (KGS). I guess the thing to watch this morning is Oneok LP (OKS) which reported huge numbers last night and raised guidance for the rest of the year at 2009. If you can't get a reaction to that...its over!

The Street.com (subscription required) has a piece on Billionaire Carlos Slim investing in MLPS. Isn't it nice to know you have a billionaire hanging out with us in this misery. At least it offers hope.

Crude a little higher this morning ahead of the energy numbers and so is natural gas. Energy stocks look a touch firm as a whole this morning so we should see some upticks at the open. After that its anyone's guess. Scroll down to last nights post for details about heavy insider buys at a few MLPS. No upgrades or downgrades so far this morning

Finally We could all stand a quick laugh. 13 points in 2 days!

4 individuals made at the market insider buys in Buckeye Partners including the CEO. Also 2 insider buys at Holly Partners (HEP). Dan Duncan buys Duncan Partners (DEP)...and buys and buys and buys.

Also after the close Oneok Partners posted excellent earnings and boosted its views for the rest of 2008 and 2009. Stocking bidding up after hours. Also earnings from Martin Midstream (MMLP). K-Sea (KSP) put up numbers and a guidance range. Looks like that range is below estimates but sometimes it matters and sometimes it doesn't. From this morning Magellan (MMP) put up good earnings and guidance. Didn't matter there as the stock was down today.

And so it goes. Wish i knew what it would take to get these things to bounce but we're back to 2005 levels in here. I am forever an optimist and we know they can't go to zero if its any consolation. Maybe we saw more unwinding of the hedge fund blow up today. Certainly felt like a continuation of yesterday. The selling stopped around 3:30pm. I'm just clueless really about what is going on other than the obvious things we've all gone over these many agonizing months.

A few winners like DCP Midstream (DPM) Duncan Partners (DEP) Nustar Holdings (NSH) Calumet Specialty Products (CLMT) Genisis Parnters (GEL) and Sunoco Logisitcs (SXL) among a few others.

Blah Blah Blah!. MLPS are being called DOG FECES! Now that is anger!

Its ugly out there as commodities and crude continue to see the air come out of the bag. And they took it out on MLPS yesterday as we saw 8 points come off the index or 3+% and we are just above that 262 level that has held before. The damage yesterday was extensive and we wait and see this morning whether we decend even further or put in another reversal in here.

The weeklu chart takes us back to the breakout in 2006 and if you draw a line across 262 you can see it takes you just above those breakout points which why this level is so important. Stock futures are strong this morning pre-open and i guess the mystery is will we follow the overall market and bounce or will we follow what the rest of the energy stocks do in the face of falling oil and gas

The weeklu chart takes us back to the breakout in 2006 and if you draw a line across 262 you can see it takes you just above those breakout points which why this level is so important. Stock futures are strong this morning pre-open and i guess the mystery is will we follow the overall market and bounce or will we follow what the rest of the energy stocks do in the face of falling oil and gas Those big energy stocks have been in free fall on the Dow Jones Oil and Gas index and there is no sign of a bottom here nor are there any signs of a bottom on the crude oil (USO) or the natural gas charts (UNG) which follow below.

Those big energy stocks have been in free fall on the Dow Jones Oil and Gas index and there is no sign of a bottom here nor are there any signs of a bottom on the crude oil (USO) or the natural gas charts (UNG) which follow below. The USO has broken support and is under 120 on cride this morning. And natural gas has aboslutely crashed as we are now at 8.50 on nat gas.

The USO has broken support and is under 120 on cride this morning. And natural gas has aboslutely crashed as we are now at 8.50 on nat gas.

No corporate developements this morning. No upgrades or downgrades so far either. More ex-distributions on the tape this morning so at least those (very high) yield checks continue to at least cushion this although losing 10% to gain 2% for a quarter is hardly a way to get ahead as several of you have pointed out in your posts.

So we wait for another day of torture. Maybe the strengthening dollar will bring money into the group. We can only hope and pray. I think the action in mlps truly show us just how broken the credit markets really are.

Monday, August 04, 2008

262 held again...barely. Glory!

In all seriousness the tape in anything commodities did have the feel of someone unwinding a big position. Usually these things happen near bottoms but we have sung that song before.

Buckeye Partners (BPL) is down 2. Holly Partners (HEP) is also a 2 point losers. And we have a long list of 1 point losers or losers of major fractions.

I guess 262 is in play again.

Ugh! Waking up from a summer weekend and not much happening this morning. We have Citigroup downgrading Buckeye Parnters (BPL) and dropping their target which is, as always, a stroke of brilliance after the decline. More ex- distributions over the next few days so at least the check is in the mail, or will be. Stock futures a touch lower. Energy is lower this morning as Tropical Storm Edouard heads toward Houston with what should be minimal impact. No corporate developements. Try and stay awake this morning.

Be sure to scroll down to my weekend post with the link to the FT article about takeovers in MLP land. Worth reading.

I will post later this morning as things get underway.

Saturday, August 02, 2008

Friday, August 01, 2008

Not too much on the losing side and most of that is on very light volume which is good. Also beware that sometimes a nasdaq mlp is listed as down even though its ex-distribution.They are not as neat about those things as the NYSE.

Might have a shot at closing near the highs of the week and we haven't done that in a long long time.

Of course there is! There is always hope. And in bear markets is the eternal search for the bottom that never comes. Well we have been suffering 1 year into this mess and we are down 20+% on the mlp index. But in that eternal search we seem to be holding 262 and we have been also seeing big multipoint moves up and down since last Monday. That action tells me that at least a tradeable bottom has formed and we will be trying to perhaps take things back up toward 290 on the MLP index.

I actually was quite pleased with yesterday's action. The index had every reason to completely fall apart as it has so many times in these past many weeks and we finished with a 1 point loss. And it took a 200 pt dow sell off and a 3% loss in big energy and we still managed to close off the days lows. There were some smart upticks in price in a few issues yesterday as well. The big energy stocks are in sell off mode so perhaps we are beginning to see some sort of divergence developing.

I actually was quite pleased with yesterday's action. The index had every reason to completely fall apart as it has so many times in these past many weeks and we finished with a 1 point loss. And it took a 200 pt dow sell off and a 3% loss in big energy and we still managed to close off the days lows. There were some smart upticks in price in a few issues yesterday as well. The big energy stocks are in sell off mode so perhaps we are beginning to see some sort of divergence developing. So we will keep our eyes on this and lets watch the dow chart which also is behaving like we are in the beginnings of a trading rally. Where and how high it will take us i don't know. Also note that in the past important market bottoms have been made in the August to October time frame.

So we will keep our eyes on this and lets watch the dow chart which also is behaving like we are in the beginnings of a trading rally. Where and how high it will take us i don't know. Also note that in the past important market bottoms have been made in the August to October time frame.

Friday's typically do not bring much in corporate developements. We had earnings last night and distribution guidance from Atlas Pipeline Partners(APL) and Atlas Holdings (AHD). All of this will be digested this morning. Also we had earnings from TC Pipelines (TCLP) and they were strong.

No upgrades or downgrades so far. Holly Partners (HEP) got an intraday boost yesterday from Goldman and UBS so the stock went from being down 2 to being up 2 in a hurry. So that turned into a nice trading profit for me that occured in a hurry. Sold it in the afternoon a little early but a profit is a profit and these days its been a tough find so you grab em when you can.