Hiland Partners is down 1 and Martin Midstream is down fractionally but these guys trade on the thin side so a buy or two and suddely you could be unchanged.

LIN Energy (LIN) news last night of no new equity offering necessary and a 2.08 annual distribution rate for next quarter is driving the stock nicely higher. As viewed last night this one could run to 27-28 based on a 7% yield going foward.

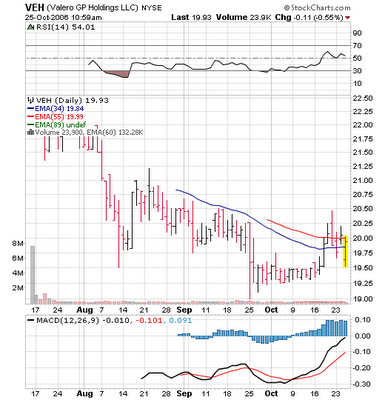

I would also like to address Valero GP (VEH) and Atlas Holdings (AHG). We've seen nice moves in the underlying LP's in the last week but the GP's haven't done much. I know there are stock overhang issues regarding Valero LP and probably a few others in the group. But I would think that the GP's will eventually catch up in terms of performance.

No comments:

Post a Comment