Looks like whatever correction there was is done and we're moving ahead nicely going into the last hour of trading. The MLP index is now up 15 cents but it is being dragged today by Kinder Morgan Partners down 30 cents and Enterprise down 15 cents which make up about 20% of the index. Most MLPS are higher and the Markwest pair are sharply higher. Markwest Hydrocarbon which was near 28 late Septembe...MWP is up 1.57 to 41 and change and Markwest LP (MWE) is also up a buck. Lots of fractional gains across the board.

Enterprise Equity (EPE) is down a buck with no specific news there.

I added a new link on the blog roll...Insider Trading at Netsteering which looks like a good place to view all the sec filings for buying and selling among other things...so please drop buy and give it a try.

Thursday, November 30, 2006

A pretty contained correction this morning in MLPS and in energy. Nat gas numbers were bullish but we seem to be contained. Nonetheless not bad after yesterday. The MLP index is down 20 cents...most of that is Kinder Morgan which is down 24 cents right now. Hiland Partners is up 1 and change. Nothing news driven today so most MLPS are between plus 30 cents and minus 30 cents. Enjoy lunch and lets see if we have the drivers for an up close.

CHART BREAKOUTS EVERYWHERE...MORE UPSIDE LIKELY!

After yesterday's big upside in anything energy lets take a look at some charts which could give us a clue of what lies ahead.

First off is our AMZ MLP index which closed yesterday at a new all time high. The weekly chart broke out 3 weeks ago and i think we still have quite a bit to go here...my first upside target is the 300 level.

Below we have the XOI chart which is doing a very good job of running back to its all time high in the 1220-30 zone. This move looks very powerful and we should see this upleg clear the prior highs shortly.

Meanwhile I had not looked at this in awhile but the XNG index which is the index of big nat gas stocks has clearly broken out to new all time highs.

Isn't it interesting that the stock indexes in energy have moved so strongly during a stretch where oil prices have been going back and forth between 55 and 60 dollars. Yesterday we broke through to 62 dollars and we're higher this morning again. At least from the standpoint of the stocks i think the market is telling us that at these prices companies will be making lots of money. Nat gas has been moving higher for awhile off its bottom

Now take a look at the crude verses 10 year rate chart.

Rates have been falling (prices rising) since July in bonds while oil has been falling in the same stretch. Are we at another turning point here with a top in bonds and a bottom in crude? My bet here is the 10 year note will breakout to new highs. Crude has not emerged from that base yet so until we clear 64 or 65 bucks decisively , i think bonds remain in their uptrend.

All of this for MLPS means that we still have 3 strong winds at our backs...rising stock markets...favorable 10 year rates...stable to rising energy prices. And remember i don't think the energy market has priced in any kind of cold winter weather.

This morning its quiet as we have no news and no upgrades or downgrades at least so far. So i think we look for mommentum to carry us higher today at the start.

After yesterday's big upside in anything energy lets take a look at some charts which could give us a clue of what lies ahead.

First off is our AMZ MLP index which closed yesterday at a new all time high. The weekly chart broke out 3 weeks ago and i think we still have quite a bit to go here...my first upside target is the 300 level.

Below we have the XOI chart which is doing a very good job of running back to its all time high in the 1220-30 zone. This move looks very powerful and we should see this upleg clear the prior highs shortly.

Meanwhile I had not looked at this in awhile but the XNG index which is the index of big nat gas stocks has clearly broken out to new all time highs.

Isn't it interesting that the stock indexes in energy have moved so strongly during a stretch where oil prices have been going back and forth between 55 and 60 dollars. Yesterday we broke through to 62 dollars and we're higher this morning again. At least from the standpoint of the stocks i think the market is telling us that at these prices companies will be making lots of money. Nat gas has been moving higher for awhile off its bottom

Now take a look at the crude verses 10 year rate chart.

Rates have been falling (prices rising) since July in bonds while oil has been falling in the same stretch. Are we at another turning point here with a top in bonds and a bottom in crude? My bet here is the 10 year note will breakout to new highs. Crude has not emerged from that base yet so until we clear 64 or 65 bucks decisively , i think bonds remain in their uptrend.

All of this for MLPS means that we still have 3 strong winds at our backs...rising stock markets...favorable 10 year rates...stable to rising energy prices. And remember i don't think the energy market has priced in any kind of cold winter weather.

This morning its quiet as we have no news and no upgrades or downgrades at least so far. So i think we look for mommentum to carry us higher today at the start.

Wednesday, November 29, 2006

Some after hours news...first off i missed this on Energy Transfer Equity which came out with an earnings press release this morning. Kinda slipped by me. After the close Teppco (TPP) and Enterprise (EPD) announced that they have completed Jonas! Also Teppco has rescheduled its unitholders meeting and now its going to reschedule it yet again.

The MLP index closes at a new all time high and just off its highs of the day. 1 point gains in both Markwests (MWE,MWP) one Crosstex (XTXI) and Kayne Anderson (KYN) with fractional gains pretty much across the board.

The MLP index closes at a new all time high and just off its highs of the day. 1 point gains in both Markwests (MWE,MWP) one Crosstex (XTXI) and Kayne Anderson (KYN) with fractional gains pretty much across the board.

Some profit taking seems to be taking hold in here but we're still nicely higher. The AMZ MLP index nosed above 278 before pulling back a touch. Strength in the MLP trust funds as Kayne Anderson (KYN) and Tortiose Energy Infrastructure (TYG) are both up nearly 1 point each. Lots of fractional gains on the board but no real standouts...and on the losing side only a few issues with Copano (CPNO) now off its lows of the day down 38 cents.

Strong day so far with the MLP index up a point and a half and in new all time high territory. We're seeing 25 to 50 cent moves higher pretty much across the board. Only a few losers and Copano (CPNO) is really the only standout here down 60 cents as it continues to absorb its secondary offering.

Look for strength to build this afternoon as the overall market remains strong here.

Look for strength to build this afternoon as the overall market remains strong here.

RISING ENERGY...FLAT TO FALLING 10 YEAR...RISING STOCK FUTURES...LOOKS LIKE A SOLID START!

Good Morning to all and its one of those mornings where it looks like the tape will dictate the flow. Its positive on all three levels so look for an up open on MLPS. Its also a morning where there is absolutely no corporate news headlines and no upgrades or downgrades. So what to blog about? How about the weather since it will have energy impact.

6 to 10 day outlook from our friends at the National Weather Service and below we have the 8 to 14 day outlook from our same friends!

Good Morning to all and its one of those mornings where it looks like the tape will dictate the flow. Its positive on all three levels so look for an up open on MLPS. Its also a morning where there is absolutely no corporate news headlines and no upgrades or downgrades. So what to blog about? How about the weather since it will have energy impact.

6 to 10 day outlook from our friends at the National Weather Service and below we have the 8 to 14 day outlook from our same friends!

Note that the 6 to 10 day forecast and the 8 to 14 day forecast are for below normal temperatures most of the fuel eating states. So there will be at least a floor under prices for oil and natural gas. I would also like to remind you at this point that like those fabulous hurricane forecasts..."the northeast is looking down the barrel of a gun"...weather is absolutely not baked into the energy futures cake. That is why every little cold outbreak brings in a round of fresh buying and has pushed nat gas back above 8 bucks. If we lock into a 6 to 8 week colder than normal pattern look for energy prices to continue to rise.

Tuesday, November 28, 2006

Another reminder...join the MLP Discussion group and talk about your favorite MLP or your ideas on MLPS...whatever..just click the link here and sign up!

A one point gain in the MLP index which gets back most of yesterday's loss. Copano (CPNO) finishes down 2 and change on its stock offering. Otherwise we had flat to higher closes in most MLPS today.

We'll see if tomorrow takes us back in all time high territory.Meanwhile LINN Energy continues to be on the verge of another upleg imho and a close above 26 with volume could take this one to 30 very quickly.

A one point gain in the MLP index which gets back most of yesterday's loss. Copano (CPNO) finishes down 2 and change on its stock offering. Otherwise we had flat to higher closes in most MLPS today.

We'll see if tomorrow takes us back in all time high territory.Meanwhile LINN Energy continues to be on the verge of another upleg imho and a close above 26 with volume could take this one to 30 very quickly.

Copano (CPNO) is down 1 and change on the stock offering news. Markwest Energy is up 90 cents on no news and everything else is between minus 25 cents and plus 25 cents with more winners then losers. The MLP index is up .60 at 276 and change and has gotten back about half of what it lost yesterday. For the most part the trading has been relatively unispiring so far.

10 YEAR RATE BREAKS DOWN BELOW 4.50%....MLPS ???

I think my headline here is the big question today. The durable goods number has set the tone in the stocks and yield markets as yesterday's correction is set to continue. At some point if the correction deepens money will start to flow to anything with yield. So we'll let the open play itself out and I would be looking to add to any MLPS that pull back to moving average support levels. Drops can be sharp and quick so be nimble and try to stick with the ones that have been the leaders here or have been on or near the 52 week highs. The AMZ MLP index was off 1 and change yesterday but the weekly chart is completely and totally bullish...at least for now!

In the news this morning Energy Transfer Equity (ETE) has completed its priviate equity financing of its recent aquisition. Nearly 8 million shares were placed priviately at $27.41 per share.Usually these priviate placements require the holder not to sell the stock for a period of time which keeps extra shares off the market for quite a while. Also we have 2007 guidance being issued for Oneok LP (OKS) for the first time and it looks pretty good for next year. Copano last night announced it is bringing 2.5 million shares to market in a secondary so look for this one to be down a couple of points today. Penn Virginia's (PVR) comes to market today as its pricing its IPO. PVG will be the symbol. No news on the final pricing but they did take the range down. No upgrades or downgrades this morning. Stock futures are down 4 points. The energy complex is up however and pre-market energy stocks are slightly higher. So here comes the open and we'll take it from there.

I think my headline here is the big question today. The durable goods number has set the tone in the stocks and yield markets as yesterday's correction is set to continue. At some point if the correction deepens money will start to flow to anything with yield. So we'll let the open play itself out and I would be looking to add to any MLPS that pull back to moving average support levels. Drops can be sharp and quick so be nimble and try to stick with the ones that have been the leaders here or have been on or near the 52 week highs. The AMZ MLP index was off 1 and change yesterday but the weekly chart is completely and totally bullish...at least for now!

In the news this morning Energy Transfer Equity (ETE) has completed its priviate equity financing of its recent aquisition. Nearly 8 million shares were placed priviately at $27.41 per share.Usually these priviate placements require the holder not to sell the stock for a period of time which keeps extra shares off the market for quite a while. Also we have 2007 guidance being issued for Oneok LP (OKS) for the first time and it looks pretty good for next year. Copano last night announced it is bringing 2.5 million shares to market in a secondary so look for this one to be down a couple of points today. Penn Virginia's (PVR) comes to market today as its pricing its IPO. PVG will be the symbol. No news on the final pricing but they did take the range down. No upgrades or downgrades this morning. Stock futures are down 4 points. The energy complex is up however and pre-market energy stocks are slightly higher. So here comes the open and we'll take it from there.

Monday, November 27, 2006

A reminder folks...we have started a discussion group for Master Limited Partnership Stocks so maybe we can all post in one place...just for us. So click above and join the party.

Meanwhile some after hours news as Copano (CPNO) has decided that now would be a good time to do a stock offering of 2.5 million shares. The stock has doubled in price in the last year so I guess this would be a good place to do it.

Penn Virginia Resources is IPO-ing its GP and they've lowered the price range.

That's it for after hours corporate news. Oil and Nat gas are both slightly higher in evening electronic trading with S&P futures slighty higher as well.

Meanwhile some after hours news as Copano (CPNO) has decided that now would be a good time to do a stock offering of 2.5 million shares. The stock has doubled in price in the last year so I guess this would be a good place to do it.

Penn Virginia Resources is IPO-ing its GP and they've lowered the price range.

That's it for after hours corporate news. Oil and Nat gas are both slightly higher in evening electronic trading with S&P futures slighty higher as well.

Not easy on a day like today when the dow is down 165 and nasdaq down 50 but there are a few silver linings. The MLP index is down 1.25 which is not too bad. And there are a few winners like Inergy Group Holdings (NGRP) which is up 1 and change and Calumet Product Partners (CLMT) which is up nearly 1. Many more losers than winners but it really just looks like profit taking.

While is was up earlier in new all time high territory the MLP index is down .70 as the overall market sell off of down minus 150 is keeping things on hold. Nothing outstanding on the downside as the recent big winners like Markwest Hydrocarbon, Oneok LP and a few others take a hal a dollar hit. Duke Midstream is up and Calumet Partners is up 1 and change and at new highs.

MONDAY AFTER THANKSGIVING..WHO IS BREAKING OUT?

Its Monday and its a bit hard to get going this morning but let us begin with some news on Regency Partners as it begins a placement of some senior notes. Also we have breaking news on Natural Resource Partners as they buy another coal operation. Thats it on headlines so far this morning. No upgrades or downgrades to speak of so far but the morning is young.

Meanwhile I have 2 charts this morning that look like they are getting ready to begin another upleg. Energy Transfer Equity which lately has been lagging Energy Transfer Partners has been absorbing some supply from its recent deal financing structure. The chart says to me that this may have now been fully discounted and that ETE could begin playing some catch up.

Meanwhile there is LIN Energy (LINE)which has already pre-announced its next quarter distribution which takes it to 2.07 annual. Right now this MLP is priced to yield 7.9% on the new distribution while it trades at 6.60% this morning on the old distribution. So this stock should actually be trading around 31 to reflect that yield.

Sooner or later the market will wake up to that and push the stock where it belongs imho.

There was an ipo last week of a new MLP... Constellation Energy Partners (CEP)

which is from...get ready now...Constellation Energy! Hat tip to Hrisdon for picking up on this. I will check out the details but it looks like it was recieved okay by the markets.

Over the weekend i've been setting up a bulletin board just for us MLP users. I have been adding the companies to the list and if you don't see yours or if i've missed one please leave me a note by leaving a comment on the link provided at the end of this post. I have also added a bulletin board link on the blogroll to the side.

Its Monday and its a bit hard to get going this morning but let us begin with some news on Regency Partners as it begins a placement of some senior notes. Also we have breaking news on Natural Resource Partners as they buy another coal operation. Thats it on headlines so far this morning. No upgrades or downgrades to speak of so far but the morning is young.

Meanwhile I have 2 charts this morning that look like they are getting ready to begin another upleg. Energy Transfer Equity which lately has been lagging Energy Transfer Partners has been absorbing some supply from its recent deal financing structure. The chart says to me that this may have now been fully discounted and that ETE could begin playing some catch up.

Meanwhile there is LIN Energy (LINE)which has already pre-announced its next quarter distribution which takes it to 2.07 annual. Right now this MLP is priced to yield 7.9% on the new distribution while it trades at 6.60% this morning on the old distribution. So this stock should actually be trading around 31 to reflect that yield.

Sooner or later the market will wake up to that and push the stock where it belongs imho.

There was an ipo last week of a new MLP... Constellation Energy Partners (CEP)

which is from...get ready now...Constellation Energy! Hat tip to Hrisdon for picking up on this. I will check out the details but it looks like it was recieved okay by the markets.

Over the weekend i've been setting up a bulletin board just for us MLP users. I have been adding the companies to the list and if you don't see yours or if i've missed one please leave me a note by leaving a comment on the link provided at the end of this post. I have also added a bulletin board link on the blogroll to the side.

Sunday, November 26, 2006

OKAY HOW ABOUT A DISCUSSION GROUP JUST FOR US MLP FOLKS?

Okay folks...i'm trying something here. Between Yahoo, Investor Village and a few other places we have people discussing MLPS all over the internet. And as a reader who emailed me reminded me...it was time to go to work and put together a discussion group where we could all come together in one place. Now this is a work in progress as i am trying to figure this all out on the fly. What I'm doing is creating a discussion group for each MLP. I i forgot one..let me know and i'll set the discussion up. This is a work in progress and the link above will take you there. Lets see if we can get together all in once place for good conversation and a healthy exchange of ideas.

Subscribe to MASTER LIMITED PARTNERSHIPS |

Visit this group |

Okay folks...i'm trying something here. Between Yahoo, Investor Village and a few other places we have people discussing MLPS all over the internet. And as a reader who emailed me reminded me...it was time to go to work and put together a discussion group where we could all come together in one place. Now this is a work in progress as i am trying to figure this all out on the fly. What I'm doing is creating a discussion group for each MLP. I i forgot one..let me know and i'll set the discussion up. This is a work in progress and the link above will take you there. Lets see if we can get together all in once place for good conversation and a healthy exchange of ideas.

Friday, November 24, 2006

DAY AFTER THANKSGIVING....ALL IS QUIET ON THE MLP FRONT

We have an upside bias in what is the slowest trading day of the year. No news...no upgrades or downgrades so unless something earthshattering happens it should be just appointment only trading today and back to normal Monday. But I will be watching just in case.

We have an upside bias in what is the slowest trading day of the year. No news...no upgrades or downgrades so unless something earthshattering happens it should be just appointment only trading today and back to normal Monday. But I will be watching just in case.

Wednesday, November 22, 2006

Lower at lunchtime with the bearish Oil numbers and the slightly bullish gas numbers and net net we're lower by .80 and the board has more losers than winners. Markwest Hydrocarbon (MWP) and Williams Partners (WPZ) are the biggest losers with both down over 1 point. Most others are fractional losers. Duke Midstream (DPM)and Energy Transfer Equtiy(ETE) are both up about 50 cents a piece are 2 winners today.

Good Morning.

The day before Thanksgiving and I suspect this will be one of those days where most of the action will be done by 12 noon or so. Energy numbers are due out at 10:30am and that should be a mover. So far this morning there are no corporate developements and no upgrades or downgrades.

Kinder Morgan Partners was a big mover yesterday up 84 cents and it looks like it will challenge the low 50s before too long. AMZ Index watchers will like the chart below.

It seems to be in "runaway upside mode" so pullbacks in MLPS should be used as buying opportunities. We have a long way to go.

The day before Thanksgiving and I suspect this will be one of those days where most of the action will be done by 12 noon or so. Energy numbers are due out at 10:30am and that should be a mover. So far this morning there are no corporate developements and no upgrades or downgrades.

Kinder Morgan Partners was a big mover yesterday up 84 cents and it looks like it will challenge the low 50s before too long. AMZ Index watchers will like the chart below.

It seems to be in "runaway upside mode" so pullbacks in MLPS should be used as buying opportunities. We have a long way to go.

Tuesday, November 21, 2006

Afternoon trading and the MLP index is at the highs for the day up 1.44 and almost the whole group is higher. Calumet(CLMT), Oneok LP(OKS), and Kinder Morgan Partners (KMP) are up major fractions. Markwest Energy LP (MWE)and Hiland LP(HLND) have given up earlier gains but are still higher. New issue Eagle Rock (EROC) is up 50 cents today. Valero Holdings (VEH) has now turned higher and even though it was only 250 shares we did have an insider buy yesterday. Higher oil and natgas prices lifting the big energy and gas stocks with the XOI and the XNG both solidly higher and certainly supportive today along with a flat 10 year.

A sea of green this morning with the MLP index up a bit over 1 point and we have Hiland LP up 2.05 (its one trade of 100 shares at that price) and Markwest Energy up 1 and change to 57. A whole host of issues with fractional gains. One or two losers down pennies.

Crosstex (XTXI) was down over 3 at one point on the the 3 for 1 stock split news. I've been wondering whether we can't take out 100 on this is a sign that we're in one of those basing periods again that could last awhile. If it is the case we could see this break down below 90 at some point before breaking out over 100. Food for thought here.

The Oppenheimer move this morning is boosting Enterprise (EPE) up 40 cents but it has done nothing for Energy Transfer Equity (ETE) which is down 2 cents on the buy recommendation.

Crosstex (XTXI) was down over 3 at one point on the the 3 for 1 stock split news. I've been wondering whether we can't take out 100 on this is a sign that we're in one of those basing periods again that could last awhile. If it is the case we could see this break down below 90 at some point before breaking out over 100. Food for thought here.

The Oppenheimer move this morning is boosting Enterprise (EPE) up 40 cents but it has done nothing for Energy Transfer Equity (ETE) which is down 2 cents on the buy recommendation.

OPPENHEIMER ON THE HORN THIS MORNING...ENERGY COMPLEX HIGHER

The folks at Oppenheimer are telling us this morning that we should buy 2 GP's (general partners) and they are Energy Transfer Equity (ETE) with a $33 target and Enterprise Holdings (EPE) with a $39 target. Energy Transfer Equity (ETE) has recently underperformed Energy Transfer Partners (ETP) and some healthy and informative debate has broken out on the Yahoo message board about this. Its worth a read as it provides some interesting views on the situation.

The same underperformance holds true for Enterprise Equity(EPE) verses Enterprise Products Partners (EPD). EPD's yield is 6.50% vs 3.80% for EPE.

As far as the next 2 are concerned the yield spread is much tighter; 5.60% for ETP vs 4.40% for ETE.

Which one you perfer to own...or perhaps you could own both...or neither would depend on among other things tax issues, yield, and whatever else could come to mind. Certainly EPD and ETP have been solid leaders in this upleg and show now signs of relinquishing that leadership. GP's have not done as well in this move but ETE clearly has the better looking chart than EPE.

Speaking of GP's the best performer of the last 12-18 months has been Crosstex (XTXI) which has nearly tripled in value. And now with the stock near 100 bucks the company has approved a previously announced 3 for 1 stock split!

Nice chart!

In the news department this morinng we are dry...nothing going on corporate wise. Crude Oil is nicely higher up 60 cents so far this morning. The 10 year is flat at 4.60% Natural gas is down 4 cents.

The folks at Oppenheimer are telling us this morning that we should buy 2 GP's (general partners) and they are Energy Transfer Equity (ETE) with a $33 target and Enterprise Holdings (EPE) with a $39 target. Energy Transfer Equity (ETE) has recently underperformed Energy Transfer Partners (ETP) and some healthy and informative debate has broken out on the Yahoo message board about this. Its worth a read as it provides some interesting views on the situation.

The same underperformance holds true for Enterprise Equity(EPE) verses Enterprise Products Partners (EPD). EPD's yield is 6.50% vs 3.80% for EPE.

As far as the next 2 are concerned the yield spread is much tighter; 5.60% for ETP vs 4.40% for ETE.

Which one you perfer to own...or perhaps you could own both...or neither would depend on among other things tax issues, yield, and whatever else could come to mind. Certainly EPD and ETP have been solid leaders in this upleg and show now signs of relinquishing that leadership. GP's have not done as well in this move but ETE clearly has the better looking chart than EPE.

Speaking of GP's the best performer of the last 12-18 months has been Crosstex (XTXI) which has nearly tripled in value. And now with the stock near 100 bucks the company has approved a previously announced 3 for 1 stock split!

Nice chart!

In the news department this morinng we are dry...nothing going on corporate wise. Crude Oil is nicely higher up 60 cents so far this morning. The 10 year is flat at 4.60% Natural gas is down 4 cents.

Monday, November 20, 2006

WATCHING THE FOLLOWING MLPS FOR GOOD ENTRY POINTS

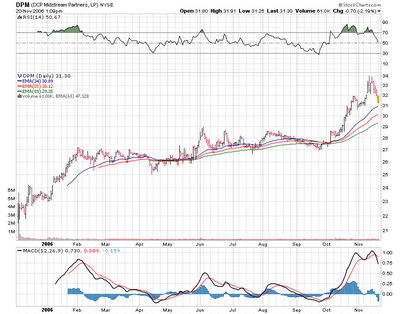

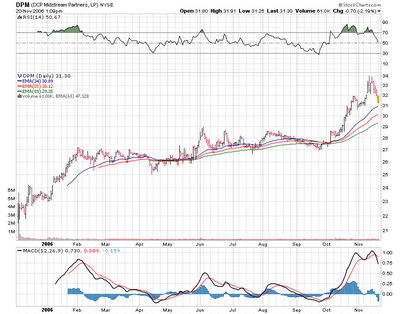

I'm putting up the following 2 charts as examples of MLPS that have recently had good runs and may be now correcting.

Regency Partners has moved nicely from 23 to 27 and now looks to be pulling back and may be base building again. Use the moving averages as logical points of entry as you ladder in. Last week the stock dropped to 24.69 intraday and I would think we could go back down into the 24 area as a bottom for this new base.

Duke Midstream (DPM) has also had a nice run from 27 to 33 and is also pulling back. The same applies here. Watch the moving average values and I would look for a drop to 30-31 zone as a good place to start looking. Assuming the major uptrend in the group remains in tact these corrections will be just that and support should hold.

Not much else happening here in mid afternoon trading. There has been a slight downward bias since lunch time with the index down .33 at 274 and change. Individual issues have been in about the same ranges as earlier.

I'm putting up the following 2 charts as examples of MLPS that have recently had good runs and may be now correcting.

Regency Partners has moved nicely from 23 to 27 and now looks to be pulling back and may be base building again. Use the moving averages as logical points of entry as you ladder in. Last week the stock dropped to 24.69 intraday and I would think we could go back down into the 24 area as a bottom for this new base.

Duke Midstream (DPM) has also had a nice run from 27 to 33 and is also pulling back. The same applies here. Watch the moving average values and I would look for a drop to 30-31 zone as a good place to start looking. Assuming the major uptrend in the group remains in tact these corrections will be just that and support should hold.

Not much else happening here in mid afternoon trading. There has been a slight downward bias since lunch time with the index down .33 at 274 and change. Individual issues have been in about the same ranges as earlier.

Both Valero LP (VLI) and Valero GP(VEH) are down 69 cents each with VEH of course being the bigger percentage loser. They both lead the losers list today while Plains All American(PAA) is up nearly 1 as is Markwest Hydrocarbon (MWP). Otherwise its a flat start on the MLP index as it is down .05 at the momment. Nothing much of note otherwise. Most issues are trading between plus and minus 30 cents.

MONDAY MORNING....SECONDARY OFFERING....OR IS IT?..AND ITS NEW ALL TIME HIGH TERRITORY TO START THANKSGIVING WEEK!

Its Monday morning of Thanksgiving week which effectively means 3 days of trading spread out over 4 as we are closed Thursday. Its a quiet news morning in this group with not much happening so far. Boardwalk Partners however hits the wires with news that its open season on pipelines (Wabbit Season...Duck Season for you Bugs Bunny Fans!).

In the land of upgrades and downgrades we have Lehman resuming coverage this morning on Plains All American (PAA) with an outperform and a $55 price target. No other upgrades or downgrades at least so far.

Last Friday after the close Valero Holdings (VEH) announced that it has filed for a "secondary offering" of 22 million shares. We're all use to secondary offerings of new shares from time to time in the MLP group as money is raised for new aquisitions etc etc. But in this particular case these are not new shares. These are shares that Valero Energy (VLI) has held since the public offering and it has been their intention since day one that the company would sell all its shares.

Meanwhile Valero Holdings has been an underperform since its ipo and is still trading below its opening price of 22 bucks. And I suspect that this news will keep some selling pressure on the shares. In fact they are already being offered below Friday's close. But this secondary is not an offering for new shares so there is no dilution here. This sale by Valero (VLI) has been in the cards since day one and many have argued that the overhang of those shares hitting the market has kept this stock price down. I think this could be a buying opportunity because again no dilution here. And once the news is absorbed we could see this one finally start moving. Watch support levels at the moving averages . They could serve as good entry points and laddering in is always a good way to accumulate a position.

Its Monday morning of Thanksgiving week which effectively means 3 days of trading spread out over 4 as we are closed Thursday. Its a quiet news morning in this group with not much happening so far. Boardwalk Partners however hits the wires with news that its open season on pipelines (Wabbit Season...Duck Season for you Bugs Bunny Fans!).

In the land of upgrades and downgrades we have Lehman resuming coverage this morning on Plains All American (PAA) with an outperform and a $55 price target. No other upgrades or downgrades at least so far.

Last Friday after the close Valero Holdings (VEH) announced that it has filed for a "secondary offering" of 22 million shares. We're all use to secondary offerings of new shares from time to time in the MLP group as money is raised for new aquisitions etc etc. But in this particular case these are not new shares. These are shares that Valero Energy (VLI) has held since the public offering and it has been their intention since day one that the company would sell all its shares.

Meanwhile Valero Holdings has been an underperform since its ipo and is still trading below its opening price of 22 bucks. And I suspect that this news will keep some selling pressure on the shares. In fact they are already being offered below Friday's close. But this secondary is not an offering for new shares so there is no dilution here. This sale by Valero (VLI) has been in the cards since day one and many have argued that the overhang of those shares hitting the market has kept this stock price down. I think this could be a buying opportunity because again no dilution here. And once the news is absorbed we could see this one finally start moving. Watch support levels at the moving averages . They could serve as good entry points and laddering in is always a good way to accumulate a position.

Friday, November 17, 2006

Hard to argue with this chart as the MLP index closed one tick below the high for the day and the week and at new all time highs. Should see a continuation next week with small corrections along the way.

After the close Valero Holdings (VEH) the general partner of Valero LP(VLI) filed a registration statment. What has been holding this stock back has been the potential overhang of stock that Valero (VLO) holds and will be getting rid of. Now we know that the shares will be coming soon and I think once that offering is out of the way this one should go higher long term.

Breaking news with Crosstex Energy(XTEX) as it signs a pact with Boardwalk Partners(BWP). Looks like Barnett Shale is moving right along!

The MLP Index has broken above 274 and is in new high ground again. Strength has been building but it has not quite spread out to all MLPS....at least not yet.

The MLP Index has broken above 274 and is in new high ground again. Strength has been building but it has not quite spread out to all MLPS....at least not yet.

I was chart hopping and found that Natural Resource Partners(NRP)could be another MLP getting ready to emerge out if its long base. Hard to get clues from the daily chart which has been in a 10 point range for the last 12 months.

I can't get a feel for this one honestly since it seems to move up or down pretty quickly. But since the group is bullish i have to bet we'll be heading back to that 58 top before the 48 bottom.

Welcome to all the Value Forum investors...take a look around and please feel free to email or commment!

The MLP Index is rallying and at the high of the day at 273.60. The big boys like Kinder Morgan Partners (KMP) and Oneok LP (OKS) for example are getting pushed higher first and if the gains hold look for the buying to spread into the rest of the group. Looks like we're taking our cue from the XOI and XNG indexes which are now at their highs of the day...up 5 and 4 points respectively.

The MLP Index is rallying and at the high of the day at 273.60. The big boys like Kinder Morgan Partners (KMP) and Oneok LP (OKS) for example are getting pushed higher first and if the gains hold look for the buying to spread into the rest of the group. Looks like we're taking our cue from the XOI and XNG indexes which are now at their highs of the day...up 5 and 4 points respectively.

Some of the mlp energy trusts like FMO,KYN,TYY,TYG are all up nicely today especially FMO which is up 1 dollar. The only thing i could think of is that maybe they got some of the NYMEX IPO?

Otherwise we're moving sideways here with some exceptions. Crosstex (XTXI) is down 2 and the lp (XTEX) is down 84 cents. No news here. Martin Midstream(MMLP) Natural Resource Partners(NRP) Regency Partners (RGNC) down major fractions as well. A few winners but other than the trusts mentioned above...nothing worth noting. The MLP index opened down...then rallied and is now down .25 at just under 273.

Otherwise we're moving sideways here with some exceptions. Crosstex (XTXI) is down 2 and the lp (XTEX) is down 84 cents. No news here. Martin Midstream(MMLP) Natural Resource Partners(NRP) Regency Partners (RGNC) down major fractions as well. A few winners but other than the trusts mentioned above...nothing worth noting. The MLP index opened down...then rallied and is now down .25 at just under 273.

Good Morning!

Friday morning and we see Crude Oil down again and with a 55 handle (55.05 as of this posting!); this after yesterday's $2.50 decline. Nat gas however is up this morning and we have flat 10 year rates waiting for housing data. So MLPS start just pennies below all time high territory and somehow they managed to hold on yesterday while big energy stocks got hammered....the XOI was down nearly 3% on the day.

So the question is do we get pulled down with the rest of energy today and play catch up?

Clearly the daily chart is extended here and a pullback here would be a buying oppourtunity to pick up the better performers at lower prices. We believe that this is in the context of a longer term bull move.

The weekly chart here tells us that this is early in the bull move. So which stocks to buy. Look for the ones that have charts that look like this and use support lines as entry points. I find that the 34, 55, and 89 day moving averages work very well and one should ladder in so you are not standing around trying to pick a bottom.

Its still early in the morning but so far no news on the group and no upgrades or downgrades from anal-ist land.

Friday morning and we see Crude Oil down again and with a 55 handle (55.05 as of this posting!); this after yesterday's $2.50 decline. Nat gas however is up this morning and we have flat 10 year rates waiting for housing data. So MLPS start just pennies below all time high territory and somehow they managed to hold on yesterday while big energy stocks got hammered....the XOI was down nearly 3% on the day.

So the question is do we get pulled down with the rest of energy today and play catch up?

Clearly the daily chart is extended here and a pullback here would be a buying oppourtunity to pick up the better performers at lower prices. We believe that this is in the context of a longer term bull move.

The weekly chart here tells us that this is early in the bull move. So which stocks to buy. Look for the ones that have charts that look like this and use support lines as entry points. I find that the 34, 55, and 89 day moving averages work very well and one should ladder in so you are not standing around trying to pick a bottom.

Its still early in the morning but so far no news on the group and no upgrades or downgrades from anal-ist land.

Thursday, November 16, 2006

When the XOI is down 30 points...oil down 2 bucks...interest rates higher...nat gas lower...the fact that the index closes pretty much even (-.05) is a bit amazing really. Last 30 minutes saw the index sell off but no damage of any consequence that i could see other than some big recent winners seeing profit taking. Markwest Energy (MWE) was down 90 cents for example. Still some winners on the tape like Energy Transfer Partners (ETP) Sunoco Logistics (SXL) Copano (CPNO) and a few others.

Watching for after hours news.

Watching for after hours news.

XOI stocks are going straight down this afternoon but MLPS are higher wiht the rest of the market. The index is up .55 as it gets near 274 again. Not much happening on either side of the equation...more MLPs are up than down...and no outstanding moves other than the ones mentioned before.Waiting for the last hour which should provide some fireworks. Crude Oil has broken down below 57 and is off 2 dollars on the day.

Moving sideways after an up open as the energy markets react to the nat gas number which was bearish. The MLP index is up 10 cents right now. Some news items as we have an insider buy in Atlas Pipeline Holdings (AHD) and also from a few days ago an insider buy in Martin Midstream Partners. This occured on the selloff after earnings.

Hiland LP (HLND) and Energy Transfer Partners (ETP) are up major fractions and they are the big winners. No real outstanding losers so far today.

Hiland LP (HLND) and Energy Transfer Partners (ETP) are up major fractions and they are the big winners. No real outstanding losers so far today.

Update before the open...CPI was a good number so rates are falling and stocks rising. LIN Energy (LINE) gets reiterated OUTPERFORM by RBC Capital Markets and they raise their target price from 29 to 31 dollars. There was a 200 share Crosstex LP trade (XTEX) at 8am down 75 cents. It may be some sort of renagade trade since i see no news or no upgrade/downgrade news on the stock so far. But i will be on the alert just in case.

Good Thursday morning.

Another start at new alltime highs although we did sell off a bit in the last hour yesterday. The chart is in breakout mode and I continue to believe that we are at the beginning of a move here that will take us to 300 or higher. Meanwhile if you tried to buy Regency Partners (RGNC) on the Wachovia downgrade yesterday and laid your orders at the 34 and 55 day moving averages you may have gotten executed around 3:20pm when the bottom fell out for about 2 minutes only to bounce back to 26.50 at the close for a 1 point plus gain. One had to be patient and nimble to pull this trade off.

Meanwhile this morning Markwest Energy (MWE) files a mixed securities shelf...details to follow when a link appears. No other news but its very early this morning. CPI coming out later. Energy complex is higher this morning as we wait for nat gas numbers. Stock futures flat to soft.

Nothing yet on the upgrade downgrade list.

Wednesday, November 15, 2006

An excellent start as we are up 1.25 on the index and except for Regency (RGNC) which is down on a downgrade and Boardwalk Partners (BWP) which is down in its offering increase to 6 million shares from 5 million; everything else is higher. Solid fractional gains in a whole host of issues including Valero LP (VLI) Sunoco Logistics (SXL) Crosstex LP (XTEX), Martin Midstream (MMLP) Magellan Midstream (MMP) and many more.

Energy numbers were bullish and that has brought buyers to the XOI and XNG stocks so we should be able to build on these gains as the day wears on.

Energy numbers were bullish and that has brought buyers to the XOI and XNG stocks so we should be able to build on these gains as the day wears on.

Here is the link to the news release from last August where LIN Energy (LINE) pre-announced its 4th quarter distribution increase to 2.08!

Good Wednesday Morning!

We begin this morning at a new all time high and in breakout mode on the MLP Index. Scroll down for last night's earnings news. No breaking news so far this morning. We do have a downgrade this morning as Wachovia lowers Regency Partners (RGNC) to marketperform from outperform . They reported earnings yesterday which looked okay and the stock price held its own yesterday.

Sometimes these "downgrades" afford buying opportunitites and if you have been looking for a chance to get in at lower prices....using the moving average support lines as logical entry points is not a bad idea. The question here is whether the downgrade is at the beginning of a period where the stock doesn't do much or trends lower or whether this is a one day blip.

We have earnings this morning from Eagle Rock Partners (EROC) the new issue...its their first report since their IPO 2 weeks ago.

Not much else happening. LIN Energy(LINE) has a conference call this morning on yesterday's earnings which blew estimates away...they are revising guidance for next year and the call should clarify any questions. This one is going to a 2.08 annual distribution in January and at today's price is yielding 8.23 %!!! If priced to the group the stock should be at least near 28-29 imho.

Btw for those of you that are interested in the weightings in the MLP index this should help. Enterprise (EPD) has the biggest weighting here at nearly 15 %..Kinder Morgan Partners has a 5 % weighting. Eagle Rock is being added to the index and Pacific Energy Partners (PPX) is coming out now that the Plains All American merger is being completed.

We begin this morning at a new all time high and in breakout mode on the MLP Index. Scroll down for last night's earnings news. No breaking news so far this morning. We do have a downgrade this morning as Wachovia lowers Regency Partners (RGNC) to marketperform from outperform . They reported earnings yesterday which looked okay and the stock price held its own yesterday.

Sometimes these "downgrades" afford buying opportunitites and if you have been looking for a chance to get in at lower prices....using the moving average support lines as logical entry points is not a bad idea. The question here is whether the downgrade is at the beginning of a period where the stock doesn't do much or trends lower or whether this is a one day blip.

We have earnings this morning from Eagle Rock Partners (EROC) the new issue...its their first report since their IPO 2 weeks ago.

Not much else happening. LIN Energy(LINE) has a conference call this morning on yesterday's earnings which blew estimates away...they are revising guidance for next year and the call should clarify any questions. This one is going to a 2.08 annual distribution in January and at today's price is yielding 8.23 %!!! If priced to the group the stock should be at least near 28-29 imho.

Btw for those of you that are interested in the weightings in the MLP index this should help. Enterprise (EPD) has the biggest weighting here at nearly 15 %..Kinder Morgan Partners has a 5 % weighting. Eagle Rock is being added to the index and Pacific Energy Partners (PPX) is coming out now that the Plains All American merger is being completed.

Tuesday, November 14, 2006

Closed off the highs but still another new high on the MLP index. Right before the close LIN Energy (LINE) came out with earnings and filed its 10q. They revised guidance for 07 but said nothing about what the revision is exactly. Then I combed through the 10q and the 8k where they provide guidance numbers but i don't know what the point of reference is. Clarity is lovely isn't it. Conference call tomorrow morning will shed some light on this.

After the close new issue Eagle Rock (EROC) announced earnings. No link yet but a conference call coming tomorrow. Boardwalk Partners announces it is increasing its offering from 5 to 6 million shares. No link yet.

After the close new issue Eagle Rock (EROC) announced earnings. No link yet but a conference call coming tomorrow. Boardwalk Partners announces it is increasing its offering from 5 to 6 million shares. No link yet.

Question was raised whether Goldman put a sell out on Energy Transfer Partners...i don't see it but if they did the market isn't paying attention as the stock is down just 25 cents right now. The MLP index is moving higher up .60 and off its high...no big movers of note in either direction at least so far. Kinder Morgan Partners (KMP) is the biggest winner up 69 cents while LIN Energy is down 30 cents as the biggest loser...everything else is somewhere in between.

Looks like at least initially they will sell the news on Energy Transfer Partners. Stock is being offered for sale about 30 cents below yesterday's close. No trades yet. Also we have earnings news from Regency Partners (RGNC) which has someone time stuff in it. Transmontaigne has been cut to market perform from outperform by Wachovia. RBC Capital Markets raises its price target on Copano Energy from 61 to 64 dollars.

Stock futures strong...interest rates falling...energy prices flat to slightly higher. Should be a good start.

Stock futures strong...interest rates falling...energy prices flat to slightly higher. Should be a good start.

Good Morninig.

We're starting from a good place this morning with the MLP INDEX at new all time highs. Earnings news from last night and this morning as Energy Transfer Partners (ETP) reports numbers.... which have all kinds of stuff in them so i'm waiting to see what the apples to apples comparisons are. They did issue 07 guidance of EBITDA OF 980 million. We'll see what the market says about this but it appears to be a positive. But has the market already figured that out?

Energy Transfer's performance has been absolutley spectacular and the GP Energy Transfer Equity whose chart is below looks like its poised to breakout above the 30 level.

I am blogging early this morning so I thought we'd look at some charts of a few of the more popular and widely held MLPS.

Those of you who frequent the yahoo message boards on Kinder Morgan Partners (KMP) and Teppco (TPP) will know who Billyjoe is. He has been bearish on these two issues since the fall of Rome. And while most disagree with that position the stock has been in a downtrend since August of 2005 and has been a laggard among MLPS in the recent move. I would think that a short position here would have been profitable if one caught the exact top and covered at the recent bottom near 42-43. So we have roughly 8 points of downside minus 5 quarterly distributions you would have paid out...a 5 point profit roughly, again assuming you caught the absolute top. But it looks to me like Kinder Morgan's chart is improving and it should at least run back toward its August 05 high with this secular MLP move. Higher highs will hinge on whether the company will start growing its distributions again. So for new money it might be good for a trade here...but as a group laggard you have to consider whether you'd be better off elsewhere.

Meanwhile another Billyjoe short favorite is Teppco (TPP)

This one has been a tougher nut to crack on the short side and the weekly chart went back to its all time high before getting turned back on earnings (no distribution growth) and a downgrade last week. This one has been probably the worst performer of the group that i could find and i would avoid this one until the company starts growing its distribution again. Meanwhile what happens when a company who has been a laggard suddenly posts good numbers and begins to up its payout. You get a chart like this one.

Valero LP was doing absolutely nothing until it posted a good quarter and boosted its distribution. The stock which was just laying there between 49-51 for a long time...took off and now has run to 56 with a 91 cent payout. Notice that VLI's chart is similar to KMP' chart until they diverge in the last several weeks. So the bottom line is exactly that, the bottom line...and when these laggards start growing again they will take off. Until then I think you might be better off in some of the others.

We're starting from a good place this morning with the MLP INDEX at new all time highs. Earnings news from last night and this morning as Energy Transfer Partners (ETP) reports numbers.... which have all kinds of stuff in them so i'm waiting to see what the apples to apples comparisons are. They did issue 07 guidance of EBITDA OF 980 million. We'll see what the market says about this but it appears to be a positive. But has the market already figured that out?

Energy Transfer's performance has been absolutley spectacular and the GP Energy Transfer Equity whose chart is below looks like its poised to breakout above the 30 level.

I am blogging early this morning so I thought we'd look at some charts of a few of the more popular and widely held MLPS.

Those of you who frequent the yahoo message boards on Kinder Morgan Partners (KMP) and Teppco (TPP) will know who Billyjoe is. He has been bearish on these two issues since the fall of Rome. And while most disagree with that position the stock has been in a downtrend since August of 2005 and has been a laggard among MLPS in the recent move. I would think that a short position here would have been profitable if one caught the exact top and covered at the recent bottom near 42-43. So we have roughly 8 points of downside minus 5 quarterly distributions you would have paid out...a 5 point profit roughly, again assuming you caught the absolute top. But it looks to me like Kinder Morgan's chart is improving and it should at least run back toward its August 05 high with this secular MLP move. Higher highs will hinge on whether the company will start growing its distributions again. So for new money it might be good for a trade here...but as a group laggard you have to consider whether you'd be better off elsewhere.

Meanwhile another Billyjoe short favorite is Teppco (TPP)

This one has been a tougher nut to crack on the short side and the weekly chart went back to its all time high before getting turned back on earnings (no distribution growth) and a downgrade last week. This one has been probably the worst performer of the group that i could find and i would avoid this one until the company starts growing its distribution again. Meanwhile what happens when a company who has been a laggard suddenly posts good numbers and begins to up its payout. You get a chart like this one.

Valero LP was doing absolutely nothing until it posted a good quarter and boosted its distribution. The stock which was just laying there between 49-51 for a long time...took off and now has run to 56 with a 91 cent payout. Notice that VLI's chart is similar to KMP' chart until they diverge in the last several weeks. So the bottom line is exactly that, the bottom line...and when these laggards start growing again they will take off. Until then I think you might be better off in some of the others.

Monday, November 13, 2006

272 level on the MLP index is being challenged as we have decisively broken out here. Markwest Energy(MWE), Markwest Hydrocarbon(MWP) (which got a strong buy from Matrix Research this morning) and Energy Transfer Partners(ETP) are ripping to the upside...all three up 1 and change. Lots of strong fractional gains in Valero LP(VLI), Williams Partners(WPZ), Kinder Morgan Partners (KMP)and a few others.

Martin Midstream Partners (MMLP) is off 1.48 as the standout loser.

Martin Midstream Partners (MMLP) is off 1.48 as the standout loser.

Merrill Lynch is on the horn as it starts Energy Transfer Partners at a buy while Raymond James downgrades Martin Midstream to market perform from strong buy.

MLPS opened higher and the index is back at new all time high territory up nearly .70 so far. Markwest Energy (MWE) and Markwest Hydrocarbon (MWP) continue to rip the cover off the ball..the former up 1 and change ...the latter up a nice fraction. Energy Transfer also up nearly 75 cents on the Merril coverage. Fractional gains elsewhere in most issues.

On the downside Martin Midstream off 1 on the downgrade noted above...Natural Resource Partners down nearly 1...no news there. A few other minor losers but nothing out of the ordinary.

MLPS opened higher and the index is back at new all time high territory up nearly .70 so far. Markwest Energy (MWE) and Markwest Hydrocarbon (MWP) continue to rip the cover off the ball..the former up 1 and change ...the latter up a nice fraction. Energy Transfer also up nearly 75 cents on the Merril coverage. Fractional gains elsewhere in most issues.

On the downside Martin Midstream off 1 on the downgrade noted above...Natural Resource Partners down nearly 1...no news there. A few other minor losers but nothing out of the ordinary.

Monday morning and its as quiet as a mouse this morning with nothing on the news front and no upgrades or downgrades to start the day. 10 year is at 4.58% and approaching a breakdown possibility at 4.50%. Meanwhile the AMZ MLP index made a new alltime weekly closing high last Friday

The question is what message are the 2 indexes giving us here. We have MLP prices rising with the falling 10 year.

Could it be that the charts are telling us the economy is weak and continuing to slow...Is a recession looming here? Meanwhile we've seen rising prices while crude oil has been going down but natural gas has been steady to higher...nearing 8 bucks. Add to that what seems to be an overall attraction to stocks with yield and I think we are poised to see MLPS move much higher from here.

We have been wondering when Atlas Holdings (AHD) the GP of Atlas Pipeline Partners (APL) would wke up and apparently it may have late last week. 23 is resistence here but if that goes we could see a run to 24-25.

And while we post up charts of MLPS that we like here is one that you might want to sit back and watch for awhile. Marting Midstream Partners came out with awful earnings last week and its DCF (distributable cash flow) ratio less than 1.0 which is not a good thing. The stock was taken out and shot last Friday.

While its always tempting to try and catch bottoms I would let this one settle out for awhile. When we start to see some sort of basing action...we might re-visit.

The question is what message are the 2 indexes giving us here. We have MLP prices rising with the falling 10 year.

Could it be that the charts are telling us the economy is weak and continuing to slow...Is a recession looming here? Meanwhile we've seen rising prices while crude oil has been going down but natural gas has been steady to higher...nearing 8 bucks. Add to that what seems to be an overall attraction to stocks with yield and I think we are poised to see MLPS move much higher from here.

We have been wondering when Atlas Holdings (AHD) the GP of Atlas Pipeline Partners (APL) would wke up and apparently it may have late last week. 23 is resistence here but if that goes we could see a run to 24-25.

And while we post up charts of MLPS that we like here is one that you might want to sit back and watch for awhile. Marting Midstream Partners came out with awful earnings last week and its DCF (distributable cash flow) ratio less than 1.0 which is not a good thing. The stock was taken out and shot last Friday.

While its always tempting to try and catch bottoms I would let this one settle out for awhile. When we start to see some sort of basing action...we might re-visit.

Saturday, November 11, 2006

I've been getting emails from folks who say they haven't figured out the blog thing and how to leave comments. Well just in case...its easy...click on the comment link below the post and leave your thoughts. If you are a blogger on blogspot you can login as a blogger...otherwise post as "other" or if you need to keep your identity under wraps for crime fighting purposes...post as anonomus. You will just need to hand type in those hard to read letters which prevents bozo's from posting crap. And my email link is in the about me link which is on the side above the blog roll.

Please post your thoughts...its nice to get feedback!!!!

Please post your thoughts...its nice to get feedback!!!!

Friday, November 10, 2006

Looks like a tug of war today with a slight downside bias. The AMZ MLP index is down .50; just under 271. Martin Midstream Partners (MMLP) is down 2 dollars on disappointing earnings and an un-inspiring conference call. Penn Virginia Resources (PVR), Markwest Energy (MWE) Atlas Pipeline (APL) and a few others are down major fractions.

No big winners today...Atlas Holdings (AHD) is up 40 cents leading the way...everything else just plus or minus small fractions.

No big winners today...Atlas Holdings (AHD) is up 40 cents leading the way...everything else just plus or minus small fractions.

Good Friday Morning.

Semo-holiday atmosphere today with Veterans Day. We start the day at all time highs on the AMZ MLP index thanks to yesterday's close as the chart indicates.

The daily chart looks extended but shows no signs of slowing...meanwhile the weekly chart below as i have argued here is just now breaking out of that long 14 month base.

That last move went from 190 to 270 and the drivers at the time were rising energy prices and flat to higher interest rates (10 year). The basing period was driven by even higher energy prices into the hurricane 2005 peaks...rising 10 year rates...and rising distributions. The drivers now are flat to falling 10 year rates...flat to falling energy prices...and rising distribution rates. The breakut looks real to me and i would say my first conservative upside target on the index is the 300 level.

This morning in news land Hiland Partners(HLND) posts stronger earnings. Also I missed this the other day..Calumet Products Partners (CLMT) also posted earnings. RBC Capital Markets raised its price target on Markwest Energy (MWE) to $60 from $57...the stock is almost there now.

So as always lets get through the opening noise and see where the day takes us.

Semo-holiday atmosphere today with Veterans Day. We start the day at all time highs on the AMZ MLP index thanks to yesterday's close as the chart indicates.

The daily chart looks extended but shows no signs of slowing...meanwhile the weekly chart below as i have argued here is just now breaking out of that long 14 month base.

That last move went from 190 to 270 and the drivers at the time were rising energy prices and flat to higher interest rates (10 year). The basing period was driven by even higher energy prices into the hurricane 2005 peaks...rising 10 year rates...and rising distributions. The drivers now are flat to falling 10 year rates...flat to falling energy prices...and rising distribution rates. The breakut looks real to me and i would say my first conservative upside target on the index is the 300 level.

This morning in news land Hiland Partners(HLND) posts stronger earnings. Also I missed this the other day..Calumet Products Partners (CLMT) also posted earnings. RBC Capital Markets raised its price target on Markwest Energy (MWE) to $60 from $57...the stock is almost there now.

So as always lets get through the opening noise and see where the day takes us.

Thursday, November 09, 2006

We closed at an all time high on the MLP index even though it sold off slightly in the last half hour...most MLPS held on to their gains. If we see followthrough tomorrow we'll know this breakout is for real and that we are at the beginning of a multimonth uptrend that should carry the index to the 300 level or higher...imho.

Just about all the charts in the group look good when you look at them on a weekly basis..either the stocks have broken out long ago and moved sharply higher like Energy Transfer Partners (ETP) Oneok LP (OKS) and a few others....or they are about to breakout like Crosstex LP (XTEX) and Natural Resource Partners (NRP). As in secular uptrends if this is one...everything goes up but i think the ones that grow their distributions the fastest are the ones that will go up the most.

Just about all the charts in the group look good when you look at them on a weekly basis..either the stocks have broken out long ago and moved sharply higher like Energy Transfer Partners (ETP) Oneok LP (OKS) and a few others....or they are about to breakout like Crosstex LP (XTEX) and Natural Resource Partners (NRP). As in secular uptrends if this is one...everything goes up but i think the ones that grow their distributions the fastest are the ones that will go up the most.

Lunchtime and we went through the breakout point with ease...the index is 1 and change and is nearing the 272 level. 1 point plus gains in Copano (CPNO) Markwest Energy (MWE) and Global Partners (GLP)...Duke Midstream (DPM) is up 1 along with Inergy Group Holdings (NRGP). Fractional gains in a host of other issues.

A few losers. Crosstex Energy (XTXI,XTEX) are both down fractions to 1 point probably a hangover from yesterday's earnings which didn't really move the stock much in either direction. Transmontaigne(TLP) is down a fraction on earnings today and Teppco(TPP) is down a fraction, stinging still from Goldman's sell call.

Afternoon trading should continue the firm trend and perhaps a last hour rush higher could result.

A few losers. Crosstex Energy (XTXI,XTEX) are both down fractions to 1 point probably a hangover from yesterday's earnings which didn't really move the stock much in either direction. Transmontaigne(TLP) is down a fraction on earnings today and Teppco(TPP) is down a fraction, stinging still from Goldman's sell call.

Afternoon trading should continue the firm trend and perhaps a last hour rush higher could result.

Good Thursday Morning!

First off lets begin with the AMZMLP INDEX which may make a breakout move today to a new all time high. I will be watching the volume of indivual shares to see if volume supports the breakthough above 271. The chart looks very promising here.

Now lets go back to some news from last night as Duke Midstream Partners whose chart has been on a tear cameo out with earnings last night which beat estimates handily.

Next on the earnings parade we have numbers from Global Partners (GLP) whose chart looks like it wants to breakout here. Lets see if earnings numbers are the excuse to do so.

Next we have underperformer Atlas Holdings (AHD) the GP of Atlas Pipeline Partners (APL) which went ex-distribution yesterday and the stock actually rallied quite nicely by days end. Is this one finally done going nowhere?

And we have news from Trans Montaigne from last night; both earnings news and transaction news involving terminals. This chart also looks like its ready to start another upleg.

In upgrades and downgrades AG EDWARDS raises its price target on Markwest Energy (MWE) from $55 to $62 before the market does it for them.

10 year yield this morning down to 4.62 which is supportive. Stock futures are higher, energy complex higher as well. So lets bring on the open and see what adventures today brings.

First off lets begin with the AMZMLP INDEX which may make a breakout move today to a new all time high. I will be watching the volume of indivual shares to see if volume supports the breakthough above 271. The chart looks very promising here.

Now lets go back to some news from last night as Duke Midstream Partners whose chart has been on a tear cameo out with earnings last night which beat estimates handily.

Next on the earnings parade we have numbers from Global Partners (GLP) whose chart looks like it wants to breakout here. Lets see if earnings numbers are the excuse to do so.

Next we have underperformer Atlas Holdings (AHD) the GP of Atlas Pipeline Partners (APL) which went ex-distribution yesterday and the stock actually rallied quite nicely by days end. Is this one finally done going nowhere?

And we have news from Trans Montaigne from last night; both earnings news and transaction news involving terminals. This chart also looks like its ready to start another upleg.

In upgrades and downgrades AG EDWARDS raises its price target on Markwest Energy (MWE) from $55 to $62 before the market does it for them.

10 year yield this morning down to 4.62 which is supportive. Stock futures are higher, energy complex higher as well. So lets bring on the open and see what adventures today brings.

Wednesday, November 08, 2006

After a soft open prices have turned higher on MLPS...up near 270 on the index. Crosstex (XTXI) was down 4 points on earnings this morning is now up on the day! Markwest Energy (MWE) and Markwest Hydrocarbon (MWP) just continue to roll along..up major fractions to a point on the day. Teppco (TPP) was down 1 on the Goldman Downgrade, while TC Pipelines (TCLP) is up a few pennies on its Goldman upgrade!

My horse is running in the first race at the Meadowlands tonight...the 2 horse Hallie's Charm for those of you willing to wager! No Guarantees here since it will be here first time in the goo! (heavy rains making a sloppy track!)

My horse is running in the first race at the Meadowlands tonight...the 2 horse Hallie's Charm for those of you willing to wager! No Guarantees here since it will be here first time in the goo! (heavy rains making a sloppy track!)

Good Morning.

Its post election day. I tried to find anything that was written about the election impact on MLPS...and found nothing. If anyone does find something please either post the link in the comment section or email it to me and i will post it. We have earnings news this morning on Crosstex Energy (XTEX,XTXI) and this one is always a bit hard to read with its recent purchase of Chieftan etc etc etc. Some pre-market trading in XTXI down 25 cents on 600 shares...which may or may not mean anything.

Meanwhile we have Goldman making moves this morning on 2 mlps....TC Pipelines (TCLP) has been on the sell list has beeen upgraded to neutral. Teppco (TPP) on the other hand has been cut to a sell which you don't see to often.

In the energy markets crude is higher...stock futures lower...the 10 year yield is down 1 basis point to 4.64%. So i guess the election news plays itself through today which to me looks almost like a non-event. The oil proposition in California went down which proves that people in California can get it right sometimes! Lets work through the opening noise and go from there.

Its post election day. I tried to find anything that was written about the election impact on MLPS...and found nothing. If anyone does find something please either post the link in the comment section or email it to me and i will post it. We have earnings news this morning on Crosstex Energy (XTEX,XTXI) and this one is always a bit hard to read with its recent purchase of Chieftan etc etc etc. Some pre-market trading in XTXI down 25 cents on 600 shares...which may or may not mean anything.

Meanwhile we have Goldman making moves this morning on 2 mlps....TC Pipelines (TCLP) has been on the sell list has beeen upgraded to neutral. Teppco (TPP) on the other hand has been cut to a sell which you don't see to often.

In the energy markets crude is higher...stock futures lower...the 10 year yield is down 1 basis point to 4.64%. So i guess the election news plays itself through today which to me looks almost like a non-event. The oil proposition in California went down which proves that people in California can get it right sometimes! Lets work through the opening noise and go from there.

Tuesday, November 07, 2006

Lunchtime and while the MLP index is down a small fraction most issues are mixed. Atlas Pipeline Partners (APL) selling off slightly on the news down a fraction. Valero LP (VLI)down a fraction again as it consolidates recent gains. Fractional winners including Markwest Energy (MWE) Boardwalk Partners (BWP) and a few others.

10 year rates falling which are supportive. We'll see what the afternoon brings.

10 year rates falling which are supportive. We'll see what the afternoon brings.

rGood Tuesday Morning.

Nursing my daughter's broken arm...spent 6 hours in the emergency room after a soccer accident! So will be a bit busy today running around today. Let us begin with some earnings news from last night. Atlas Pipeline Partners (APL) and Atlas Holdings (AHD) put up their numbers last night and they look good to me but lets see comes out of the conference call. I'd be interested to know why there was no distribution boost this quarter. Also putting record numbers last night...Teppco (TPP) and they gave guidance for next year. And we have earnings from Markwest Energy (MWE) which were great...and now we know why the stock is up from the low 40s to the low 50s in the last 2 months.

This morning we have Wachovia downgrading Magellan Holdings from a buy to a hold. Its still trading under its ipo debut a few months back.

Not exactly an awe inspiring chart compared to some others in the last few months is it?

So its election day...vote early and vote often and we'll post after the open.

Nursing my daughter's broken arm...spent 6 hours in the emergency room after a soccer accident! So will be a bit busy today running around today. Let us begin with some earnings news from last night. Atlas Pipeline Partners (APL) and Atlas Holdings (AHD) put up their numbers last night and they look good to me but lets see comes out of the conference call. I'd be interested to know why there was no distribution boost this quarter. Also putting record numbers last night...Teppco (TPP) and they gave guidance for next year. And we have earnings from Markwest Energy (MWE) which were great...and now we know why the stock is up from the low 40s to the low 50s in the last 2 months.

This morning we have Wachovia downgrading Magellan Holdings from a buy to a hold. Its still trading under its ipo debut a few months back.

Not exactly an awe inspiring chart compared to some others in the last few months is it?

So its election day...vote early and vote often and we'll post after the open.

Good Tuesday Morning.

Nursing my daughter's broken arm...spent 6 hours in the emergency room after a soccer accident! So will be a bit busy today running around today. Let us begin with some earnings news from last night. Atlas Pipeline Partners (APL) and Atlas Holdings (AHD) put up their numbers last night and they look good to me but lets see comes out of the conference call. I'd be interested to know why there was no distribution boost this quarter. Also putting record numbers last night...Teppco (TPP) and they gave guidance for next year. And we have earnings from Markwest Energy (MWE) which were great...and now we know why the stock is up from the low 40s to the low 50s in the last 2 months.

This morning we have Wachovia downgrading Magellan Holdings from a buy to a hold. Its still trading under its ipo debut a few months back.

Not exactly an awe inspiring chart compared to some others in the last few months is it?

So its election day...vote early and vote often and we'll post after the open.

Nursing my daughter's broken arm...spent 6 hours in the emergency room after a soccer accident! So will be a bit busy today running around today. Let us begin with some earnings news from last night. Atlas Pipeline Partners (APL) and Atlas Holdings (AHD) put up their numbers last night and they look good to me but lets see comes out of the conference call. I'd be interested to know why there was no distribution boost this quarter. Also putting record numbers last night...Teppco (TPP) and they gave guidance for next year. And we have earnings from Markwest Energy (MWE) which were great...and now we know why the stock is up from the low 40s to the low 50s in the last 2 months.

This morning we have Wachovia downgrading Magellan Holdings from a buy to a hold. Its still trading under its ipo debut a few months back.

Not exactly an awe inspiring chart compared to some others in the last few months is it?

So its election day...vote early and vote often and we'll post after the open.

Monday, November 06, 2006

MLPS continue to firm this afternoon...nothing overally exciting mind you but firming nonetheless...carried probably by the higher overall market and a stable 10 year note. Williams Partners (WPZ), Regency Partners (RGNC) and Energy Transfer Partners (ETP) are up major fractions...Natural Resource Partners (NRP) holding on to a 1 point gain. Nothing tragic on the losing side. Valero LP (VLI) is down 60 cents...probably a breather here after many up days in a row and the usual ex-distribution headache. Copano also down nearly 1...no news there.

The MLP index is at 269.79 as of this post..up 74 cents...knocking on the door of 270 and nearing an all time high close.

The MLP index is at 269.79 as of this post..up 74 cents...knocking on the door of 270 and nearing an all time high close.

The tone today is firm with the index up a small fraction and off its high for the day. Natural Resource Partners is up 1 and change. Crosstex LP got close to 40 before pulling back off its high. Otherwise we're +25 cents to -25 cents on most issues. Copano is down nearly 1 as the biggest sloer but news is not driving anything in the group.

Getting close to lunch time. Look for MLPS to tread water near this breakout point for the time being.

Getting close to lunch time. Look for MLPS to tread water near this breakout point for the time being.

Good Monday Morning.

Not much happening this morning. We have no news and no upgrades or downgrades. The 10 year rate is at 4.74 up a couple of basis points; nothing tragic here. The energy complex is down a touch but nothing tragic there. So we look at higher stock futures to carry us at the open.

Atlas Pipeline Partners and Crosstex Energy have earnings out this week among others. Most of the ex-distributions for the quarter are done. Chartwise these stock looks solid and the AMZ MLP index is poised to breakout to a new closing all time highs. The Crosstex chart broke out of a trading range on the weekly chart...the daily chart suggests more upside here.

There was an IPO 2 weeks ago of a new MLP called Eagle Rock (EROC). My usual rule with the new ones is to let the trading settle out for the first month before considering purchase. I have yet to read through the prospectus. If anyone has and would like to post any details or observations please do so in the comment section or email me and i will post it to share with all. I'll try to get to it asap.

Not much happening this morning. We have no news and no upgrades or downgrades. The 10 year rate is at 4.74 up a couple of basis points; nothing tragic here. The energy complex is down a touch but nothing tragic there. So we look at higher stock futures to carry us at the open.