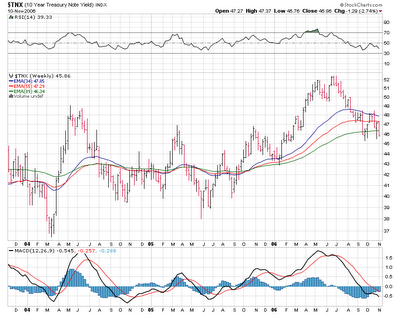

The question is what message are the 2 indexes giving us here. We have MLP prices rising with the falling 10 year.

Could it be that the charts are telling us the economy is weak and continuing to slow...Is a recession looming here? Meanwhile we've seen rising prices while crude oil has been going down but natural gas has been steady to higher...nearing 8 bucks. Add to that what seems to be an overall attraction to stocks with yield and I think we are poised to see MLPS move much higher from here.

We have been wondering when Atlas Holdings (AHD) the GP of Atlas Pipeline Partners (APL) would wke up and apparently it may have late last week. 23 is resistence here but if that goes we could see a run to 24-25.

And while we post up charts of MLPS that we like here is one that you might want to sit back and watch for awhile. Marting Midstream Partners came out with awful earnings last week and its DCF (distributable cash flow) ratio less than 1.0 which is not a good thing. The stock was taken out and shot last Friday.

While its always tempting to try and catch bottoms I would let this one settle out for awhile. When we start to see some sort of basing action...we might re-visit.

No comments:

Post a Comment