Wednesday, January 31, 2007

More new all time highs i guess in this perfect world we live in!

Calumet still leads the losers list down nearly 2 and a few others losing fractions include Markwest Energy (MWE) and Linn Energy (LINE).

Waiting for the fed.

Calumet Products (CLMT) is down 2 on the Goldman downgrade. Hiland GP (HPGP) down 21 cents on the Wachovia cut.

Crude is higher on the inventory numbers and the 10 year yield is down a touch.

Meanwhile some pre-open action in Calumet Products Partners (CLMT) on the Goldman downgrade...some trades at 44.01 down 1.79.

10 year bond opens slighty lower on the rate side at 4.86 before the GDP number.

Tuesday, January 30, 2007

On the backs of a $2.50 gain in crude and a $.70 (10%) gain in nat gas and MLPS are moving higher. The MLP index is up 1.62 and pretty much unwinds yesterday's decline. Most MLPS are either near or just off their highs of the day...even the losing ranks are thining out. Copano which was down 1 early is now nearly flat and others are just down pennies. Martin Midstream is the lone standout loser down nearly 1 dollar.

Crosstex LP (XTEX) got an underperform rating from Credit Suisse and it has actually been up most of today..right now down just a nickle.

I would imagine that baring a disaster MLPS will rally into the close.

Not many losers today. Copano and Martin Midstream are fractionally lower otherwise a few others down buy small fractions or just pennies.

Credit Suisse this morning put out opinions on a bunch of MLPS so we'll run it through for you It says Boardwalk Partners (BWP) will outperform; Williams Partners (WPZ) and Energy Transfer Partners (ETP) will be market performers; Crosstex Energy (XTEX) will underperform. Citigroup is on the horn this morning cutting Sunoco Logistics (SXL) from buy to hold and RBC Capital also cuts SXL to marketperform from outperform. Also in the hit em while their down department Wachovia is cutting Eagle Rock Partners (EROC) to market perform from outperform.

Relatively new issue E.V. Partners is updating guidance this morning which includes updating their investor presentation on their website. They are forecasting reserves will increase 191% as the Michigan deal closes. I think this could be the next "LINE" based on it having already preannounced its Q-1 distribution...based on yield this one should be in the upper 20s.

Monday, January 29, 2007

Eagle Rock (EROC) near its low of the day after cutting its outlook...down 1.70. Line Energy (LINE) is down 50 cents and nearing the 32.

Based on this chart i would back up the truck and buy if we pullback near 31 or just under it. I'm going to use the 34 day moving average as an entry point.

On the upside frational gains in Sunoco Logistics (SXL) Calumet Parnters (CLMT) and Atlas Pipeline Partners (APL).

The open approaches!!!

Monday mornning begins with news leftover from Friday night. First of Buckeye Partners (BPL) announces earnings and a distribution increase. The market ran the stock over 50 bucks ahead of this so will we see buy the rumor sell the news? Also similar news for Buckeye Holdings (BGH). Next on the list is Sunoco Logistics (SXL) which does the same thing and Magellan Midstream Partners hikes its distribution and will announce earnings on Wednesday. This morning we got earnings and a distribution hike from Alliance Resource Partners (ARLP) and they also provided 2007 guidance which i am guessing is in line with what is going on in the coal industry. We'll see what the market says.

It might not be a pretty day for Eagle Rock Partners(EROC) as its has announced earnings and a distribution but it also lowered its outlook for 2007. Raymond James downgrades the stock this morning.

Earnings for Valero LP (VLI) will be out later today. Stock had pre-announced weeks ago that it would come in below estimates. The stock was at 56 then...its over 58 now. If we get a distribution hike this one breaks back over 60 for the first time since 2005.

We have pressure on Crude oil this morning and natural gas is down as well. Ten year rates have been rallying back toward 4.90% but so far it has had no impact on the MLP index which is sitting just ticks below an all time high.

I'm not sure why we're seeing the divergence here. One view could be that distribution increases are growing faster than the pace of rate rises and that 4.90 is priced in. I would have to0 trhink that if rates start to head back over 5% that this would be a problem short term. On the other hand...10 year rates have tended to move higher ahead of fed meetings and then dropping immediately afterward. We'll see if pattern repeats this week as the fed meets.

Finally i recommend this thread that was on the Kinder Morgan Partners yahoo message board. "Abter1" posts info on A.G. Edwards and MLPS and it is followed up by a post by the always diligent CHARTNY who cruches the numbers for us. I don't want to give it all away here but its really worth the readthrough!

Friday, January 26, 2007

Just took a long position in E.V.Energy Partners (EVEP) which announced its distribution today at 40 cents or at 6.9% but it is priced to yield over 8% when you look at the pre-announced q1 of 46 cents or 1.84 annual. This could be another LINE distribution distortion and could head for the upper 20s by the end of q1. IMHO of course!

Sorry for the late morning post first post but i had to work a double shift last night. Last night Markwest Energy LP (MWE) announced a distribution boost to 1 dollar and a 2 for 1 stock split so the stock is up 1 and change this morning. Regency Partners (RGNC) is down 80 cents as it announces a distribution that perhaps was not good enough.More importantly it lowered EBITA due to project delays. That's probably having a bigger impact.

Raymond James lowers Boardwalk Partners to buy from strong buy and the stock is down 1. E.P. Partners announces its distribution and affirms the pre-announced increase for next quarter. The stock is down 20 cents.

The MLP index is down 70 cents and sits above 290. Energy is up as is big oil and gas. So lets see if this strength holds us up.

Thursday, January 25, 2007

Calumet and Atlas Pipeline Partners remain the days big winners up 70 cents each.

Linn Energy is ex distribution and is down another 75 cents. E V Partners (EVEP) is also fractionally lower as is Crosstex Energy (XTEX) and Alliance Resource Partners (ARLP).

Crude has turned higher in the last hour by 13 cents..nat gas is still off by a dime.

First off some leftover news from last night. Atlas Pipeline Partners(APL) raises its distribution buy 1 cent. Also distribution news from Atlas Holdings (AHD) as it announces a full quarter distribution...and last months ipo Atlas Resource (ATN) announces a pro-rated distribution of 6 cents...which would be 42 cents for a full quarter. Note that it makes this one priced to yield a very generous 7.3% while APL is priced to yield 6.8%. Atlas Holdings might have some upside to it although i like the prospects for all three.

In upgrades and downgrades this morning Valero GP (VEH)is downgraded to hold from buy at Wachovia. Both Valero LP(VLI) and Valero GP have been solid performers lately so this could be a buying opportunity here for VEH. Buy zones should be near the moving averages as shown but since we're in a bull move corrections will be fast and furious.

Linn Energy goes ex-distribution this morning so this could be one of those fast correction opportunities. Same applies here...For a trade i'm going to lay a buy order 2-3 points below yesterday's close of 33.99 and pray. Sometimes it works and sometimes it doesn't. BTW Linn is priced to yield 6.5% at 35 bucks based on next quarters $2.28 annual.

Growers yield in the 5-6% range so 35 to me looks like fair value for this one. Thats not to say it can't go higher longer term but in terms of the freebie that the market gave us when the stock was in the 20s....its no longer as clear cut. I still would buy any pullbacks to 30-31.50 area.

The MLP index did a bullish reversal yesterday and closed at another new all time high. We're up 7 points in the last 3 days and more upside is likely today.

I have been predicting 300 on this upleg and i'm still sticking with that upside target. When we get there i'll review to see if we have more to go. The energy complex is a few pennies higher. Natural gas is down 12 cents as it is still correcting from its big move.

Wednesday, January 24, 2007

I will monitor the after hours for any news action.

Still we do have some fractional winners including Buckeye Partners (BPL) and Atlas Holdings (AHD) along with Energy Transfer (ETP) and Alliance Holdings GP (AHGP).

Tug of war bull market intraday correction. Watch the last hour.

After yesterday's nearly 4 point rise what do we follow it up with. Follow through would be nice but a quick correction could come at the open or intraday...who knows. But the breakout was impressive and i still think 300 is easily doable here on this new upleg.

This morning we have earnings news from Enterprise Products Partners (EPD) which shows net up a nice 22%. Also this morning we have distribution hikes for both Crosstex (XTXI) and Crosstex LP (XTEX).

Nothing on the upgrade downgrade list so far this morning. Crude oil pulling back this morning after yesterday's 2 dollar plus rise. Natural gas is also correcting this morning down 12 cents after its rise over the last several days.

I just want to touch on Linn Energy (LINE) which looking at yesterday's chart broke out to a new high at 35.

Looks like we may have begun another upleg here so buying could be tough. If you bought down at 30 on that last correction...congratulations. If you are looking for another entry point use the 34 day moving average as a logical place to buy....and pray that a correction comes! As of yesteday's close its at 30.51. Frankly i can't imagine that happening today or tomorrow but sometimes these nasdaq mlps sell off 2 points or more for no reason only to bounce back within minutes. You have to be there and in position to catch em when they fall.

Tuesday, January 23, 2007

We finished with nearly a 4 point gain which in this group is astounding. Almost everything that walks talks or smells like an MLP went up today as did the rest of energy. No news so far in after hours but if anything hits...i will post.

I'd love to see the index close with a 4 point gain...28 minutes to go!

And what a day so far. The MLP index is up 3.50 and has broken through the 290 level. Lots of 1 point gains in Buckeye, Sunoco Logisitcs, Plains All American, and Calumet Products...and a slew of strong fractional gainers...pretty much across the board. Only found 2 issues down, Holly Partners (HEP) and Oneok LP (OKS)...both down a whopping 1 cent. Whoops...missed Trans Montiagne which is down 30 cents.

Unless we have a monumental shift in the planet...could we be headed for a 4 point up close on the index? Stay tuned!

In upgrades and downgrades this morning UBS initiates coverage on Atlas Energy(ATN) at a neutral...yesterdays 2 buy recomendations were only good for a 25 cent move on this one.

The MLP index yesterday has begun another upleg as it breaks out to new all time highs on action that was widespread. The daily chart shows that we've begun another up-leg and i think this one could take us to 300 at a minimum. Wind is still strongly at our backs.

No other news on the wires so far this morning and nothing else in the upgrade downgrade department.

Sometimes it pays to pay attention. Buckeye Partners (BPL) has very quietly been on an uptrend for months but when the moves each day are small you don't always pay heed. Notice the last few days the stock has spiked sharply higher. No news here that i could find but earnings and distribution announcements are due shortly. The market is obviously expecting good things based on recent action.

One last check of the upgrade downgrade department and wee see Teekay Shipping (TOO) is getting a buy recommendation from A G Edwards with a 30 dollar price target.

Monday, January 22, 2007

A few issues are down like Alliance Resource(ARLP), Crosstex (XTEX) Copano (CPNO)and a few others...but nothing that is problematic.

With the Dow down 100 points what better place to be than in yield and with energy up across the board buyers have shown up. The index is up 1.60 and it sits just over 287. Calumet Products Partners is today's big winner bu 1.41. Kinder Morgan Partners and Enterprise Products Partners both big winners today with strong fractional gains and they have about 20% of the index in terms of weighting. Smaller gains in a host of other issues.

Holly Partners (HEP)hasn't done much in the last year as it has been wavering sideways but its chart is suggesting that it may be breaking out to the upside. 43 is the clearing point.

Hiland Partners (HLND) trades thinly on Nasdaq so it doesn't really take much to move it in either direction. My guess is if they boost their distribution this should head for upper 50s to near 60.

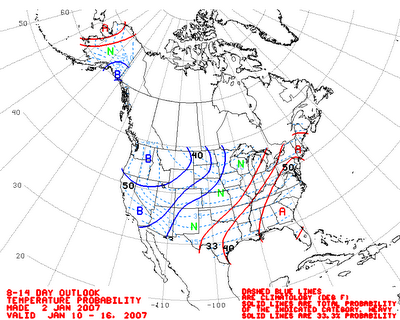

As always this is my never to be humble opinion. Speaking of which winter has arrived and the overall pattern for the next few weeks will be for below normal temperatures in the heavy energy use areas of the midwest and especially the northeast which should turn bitter for a day or 2 late in the week.

I am at a bit of a disadvantage this morning as i am finishing up a doubleshift. So i will update this post later this morning with charts and graphics regarding the MLP index, weather, and a few other ideas. Cold weather prospects remain excellent for the next 2 weeks at least propelling nat gas higher. We have 2 houses talking up Atlas Energy Resources (ATN)...RBC Capital rates it outperform and A G Edwards says buy. No other news that i could find but when i'm at work stuff slips under the radar so i'll recheck and post up later. I'm looking for a higher open and a potential new all time high close this afternoon.

Sunday, January 21, 2007

Good Sunday Evening...Normally i don't post much on the weekends but i'm working a double shift and work is slow. Just want to point out that in electronic trading...Nat gas futures are up 33 cents and crude is up about 35 cents as Friday's rally off the lows continues. Weather patterns across the US midwest and east will favor belwo normal temperatures for the next several weeks with periods of brutal cold coming. In fact the week of Jan 29th and beyond look bitter for many days. Markets are reacting since a non winter has been priced in.

Looking ahead to Monday...MLPS i think will move higher as the next up leg may have started with the MLP Index bottom at 277. I think if we break through decisively to new highs we could be on our way to 300 in short order. Watch Alliance Resource Partners and the GP (ARLP,AHGP) as they should have earnings, distribution announcements and they are into coal which may have started an up move on Friday (See ACI and BTU). These 2 need to catch up. (For disclosure purposes i own both) I also bought Holly Partners (HEP) on Friday as it looks like this one is about to breakout to new highs on the chart.

More in the morning and i'll post some charts when i get home from work tomorrow around 11am or so.

Friday, January 19, 2007

Energy Transfer Partners (ETP) and Holly Partners are the biggest losers but off their lows. Otherwise the damage is minimal to the losers.

Watch Alliance Resource Partners today as coal stocks are moving and this is an options expiration day. Last OED this stock jumped over 1 point in the last 10 minutes of trading. It has options listed. Aside from that distortion if the coal move is for real than this stock should move higher as well...imho of course.

Buckeye Partners is the biggest winner today up nearly 1 point...no news that i could find.

Friday is here and i have to start off with a quick post here as i have some stuff to do. Linn Energy raises its distribution to the preannounced 2.08 annual and reaffirms 2.28 for the next quarter. Nothing new here. I will watch to see if they sell the news and give us another entry point at lower levels. So far its up 25 cents. Morgan Stanley is upgrading Enbridge Energy Partners(EEP) from sell to hold. The stock opens up 13 cents.

The overall AMZ MLP index is flat this morning with small moves in either direction. Energy Transfer Partners however is down 1 point at sits right at 50 this morning...actually it has now broken below 50 dollars.

I'll wait for the opening noise to work through and will post again later.

Thursday, January 18, 2007

One more day left to this very eventful week. No other headlines so far this evening.

Two big fractional losers are Energy Transfer Partners (ETP) and Natural Resource Partners (NRP). Otherwise most other losers are seeing drops of 25 cents or less.

Looks like the XOI has made its stand this morning at 1100 and is well off its low. Stock action could be telling us that 50 bucks on crude is about as low as we go.

We begin this Thursday morning with distribution news fron Natural Resource Partners (NRP) which is boosting its distribution by 3 cents and issues guidance for 2007 which looks pretty optimistic. This comes on the heels of last nights Kinder Morgan Partners distribution increase. So we're on are way and MLPS begin the day coming off its recent 3 leg correction.

Looks to me like we are about to embark on another up-leg here with comfirmation coming if we break out above the 287-288 area with volume. I still think 300 is a reasonable upside target here.

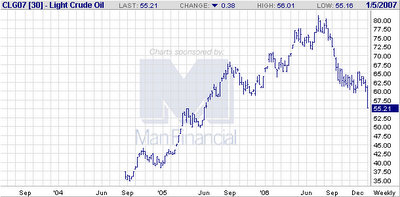

Meanwhile here is the crude chart which has now reached a level where a logical bottom place could be forming although its hard to say whether the sell-off is done or not.

I guess this is one of those watching and waiting nervous points in the crude market. Its down a few pennies this morning and now as i post it has just moved a few pennies higher.

Nothing in the upgrade downgrade department this morning at least so far. I'll be keeping an eye this morning for any developemts. The 10 year rate starts this morning at 4.78% and has ticked up to 4.80 on the inline cpi number.

Wednesday, January 17, 2007

After the close Kinder Morgan Partners came out with earnings which beat estimates by 4 cents... and a distribution increase. Also after the close the CFO of Energy Transfer (ETP) resigns after 17 years with the company. He'll stay on until they find a new CFO.

I'll be on newswatch in case other headlines come out.

Not many losers and the ones that are down are mostly down 20 cents ro less. Crude oil is up right now after being down near 50 bucks this morning...now back over 51 dollars.

18 degrees at my house this morning which i guess is a sign that winter is here. And the pattern overall will be cold to very cold for the rest of this month and heading into February. Whether that ever has any effect on crude prices remains to be seen. Meanwhile i just peaked up to see Crude down nearly a dollar and getting ready to break through the 50 dollar mark! Meanwhile as shown yesterday MLPS have diverged from the rest of energy so i think all time highs on the MLP index will be hit in short order.

Meanwhile lets backtrack to last night where we have some leftover news. Plains All American (PPA) which recently completed its merger with Pacific Energy Partners boosted its distribution by 5 cents. Also yesterday after the close we had earnings out from Energy Transfer Equity which were down but there are distortions here with regards to Energy Transfer Partners (ETP) and its aquisitions. Kinder Morgan Partners (KMP) will have earnings out today after the close with a conference call to follow.

This morning Lehman Brothers starts Penn Virginia Resources at equal weight. Nothing else so far in the upgrade downgrade department.

10 year sitting at 4.73 before the PPI number and with the core at 0.2% the yield at 4.75% imediately afterward. So far not much impact on stock futures.

Okay so we wait for the open. One thing i think we need to watch for is whether any kind of rotation developes as investors opt out of anything energy and move their money into anything but energy. What is supportive for MLPS is the fact that distributions are coming and that should really keep any selling in check. The positive divergence in the MLP index vs the XOI index indicates that the market has already figured this out.

Just a quick note about weather patterns across the U.S.A. Some of the longer range models are indicating that the weather could turn brutally cold across the midwest and especially the northeast toward the end of the month. These models tend to be very volatile from run to run but they have been showing this for a few days now so the odds of it happening are increasing. Eventually people have to start using heating oil unless they are burning extra wood like i am! And that ain't cheap either as firewood prices are up about 50% from a year ago. No way to hedge since i don't trade firewood futures!

Tuesday, January 16, 2007

Meanwhile Holly Partners is nearing a 52 week high and has been acting strong recently. Distribution announcement due shortly...it could be anticipating a boost.

Duke Midstream (DPM) is today's biggest loser down 70 cents. Also down fractionally Calumet (CLMT), Regency Partners (RGNC), General Marine (GMR) on the downgrade and Copano (CPNO).

Its another day of good relative strength of the XOI down 11 points and the AMZ which is up 1. I think the index will soon attack its recent all time high and head for 300.

Tuesday after a long holiday weekend and we come back to some selling in the Crude Oil market as it is down $1.15 this morning...giving back all of Friday's dead cat bounce. Nat Gas however is a few pennies higher as colder weather spreads into the Northeast US today. While falling crude has had the obvious impact on the big energy stocks as shown by the XOI..MLPS have shown remarkable relative strength.

News from Kinder Morgan Pipeline from yesterday as it is buying the remaining part of a Canadian pipline from BP. Earnings on Kinder Morgan Partners are due out tomorrow after the close with a conference call to follow. No other news so far this morning. Penn Virgina Resources GP (PVG) getting some attention this morning from UBS and and AG Edwards as both houses say buy the stock. Contellation LP (CEP) also getting an outpeform nod from Wachovia. General Marine (GMR) gets a cut to hold from buy from Cantor Fitzgerald.

So at least at the open we'll get some impact from big energy...look for MLPS to then go their own way. Earnings and distributions will be rolling out in the next few weaks and with another round of increases looming...i suspect we should head back to new highs on the MLP index before too long.

Friday, January 12, 2007

On the losers list only a few issues and most are down under 25 cents although Eagle Rock Partners (EROC) is down 25 cents and its a 19 dollar stock. Markwest Energy is down 51 cents and its the biggest loser today.

Crude oil has been all over the place and its now back to the flat line. The rally in the XOI is encouraging...oversold bounce for now but we'll see if crude can rally into its close. Still waiting for the bottom.

I set up a chart here comparing the XOI and the AMZ MLP index. Note that since August MLPS have clearly outperformed big energy and that divergence is at its widest point right now with respect to performance. MLPS have shown excellent relative strength here. Now you might say..."but joe...MLPS really are dependant on energy price moves"...and for the most part you are correct. Some MLPS have limited price risk but for the most part they don't. But when the market is selling a group often times they don't care. In this case they would sell anything that has the word energy in it. But given the magnitude of the sell off in big oil i am actually quite amazed that MLPS have held up as well as they have. I think a big factor is that distributions are coming so that keeps a floor under them Energy Transfer Partners however is correcting harder as they have already went ex-distribution.

Judging by the chart i think this stock has the potential to break below 50 dollars. Energy Transfer Equity's chart (below) looks much better to me as the uptrend remains in tact. Remember that ETP is already in 50-50 split land and if the company distribution continues to go even at a slower pace (which seems likely), the GP will tend to benefit more so I think ETE has more upside potential on a percentage basis. But since the LP is correcting i think you have time.

Meanwhile this morning E.V.Energy Partners (EVEP) is getting a boost by Oppenhiemer. It starts coverage here with a buy recommendation. No other news this morinng on the corporate front.

A wintry cold weather pattern will be taking over the weather maps beginning next week. And while it it won't be non-stop cold, i think temperatures for the second half of the month will average near or below normal for much of the midwest and northeast.

Thursday, January 11, 2007

No breaking developements this afternoon so will wait until after the close. I am expecting a distribution announcement from Linn Energy (LINE) any time now. BTW i just want to add that crude was down nearly 2 dollars to just above 52 bucks. The XOI actually has shown some relative strength to crude so i think that oil should be nearing a floor around 50 bucks..which i guess is logical...which means i'll be wrong! I may get interested in Exxon if it breaks under 70.

I'm at a bit of a dis-advantage this morning as i had to run into manhattan for a meeting. So i don't have access to all my news sources. As far as i can tell there are no headlines this morning and no upgrades or downgrades so far. Linn Energy Tuesday night announced a new round of hedges ; one of those stories that fell through the cracks...sorry!

Crude oil touched 53 dollars overnight and is sitting at 53.50 right now as of this posting. The XOI sold off and closed near its low yesterday telling me that there is more downside. The stocks will turn before crude so look for one of those days where crude is down and oil stocks are up sharply. That will tell you when the bottom is in.

Meanwhile MLPS are really doing well in the face of big energy going down. I think other factors are supportive here including stable 10 year rates and the prospect for fatter distributions coming in a few weeks. Usually when there is a big selloff in big energy they throw everything out the window at some point. MLPS are showing great relative strength in here when investors are throwing out the window anything involved in energy.

I will post again as soon as i get home and have a chance to go through everything.

Wednesday, January 10, 2007

Energy Transfer Partners (ETP) is the biggest loser down .75 on its earnings news from last night. Martin Midstream Partners (MMLP) and Eagle Rock (EROC) down major fractions. Other fractional losers are Markwest Energy Partners (MWE),Teppco (TPP) and Atlas Pipeline Partners (APL)

First off let me begin by admitting that while i try to stay on top of all the companies in our MLP universe inevitiably one or two falls through the cracks. Thanks to Alan for pointing this out to me with a recent MLP IPO EV Energy Partners (EVEP) which yesterday announced a deal to purchase some assets in Michigan. It has also pre-announced it distribution increase for April q1 which prices it to yield over 8%. So we have another Linn Energy situation where the market may be underpricing based on yield.

Growers imho should be yielding closer to 6% so this says to me...all things being equal that means upper 20s to near 30 here by April. $1.84 annual over a $30 gives you a 6.1% yield.

Also we have some leftover news from last night with Enterprise Products Partners (EPD) which is buying assets from Encana. And who cares about Alcoa as Energy Transfer Partners (ETP) came out with earnings yesterday which has all kinds of distortions in it but the company endorsed its previous guidance for 2007.

Now for some weather news this morning and let me caution you ahead of time. You may be hearing other things elsewhere but the bottom line is that Winter will arrive across the midwest and eastern states starting Monday in the midwest and Tuesday in the northeast. Temperatures will be near or below normal and in fact the overall pattern could turn bitterly cold toward the end of January. It looks to me like the pattern may lock in for awhile. Natural gas could continue its rally over the next few weeks if this reality sets in. Meanwhile crude oil is taking gas again this morning as we continue to sit right at the so-called critical $55 level. Yesterday the crude recovered but the XOI index closed near its low of the day. The big oil stocks are saying that the 55 buck level will not hold as i believe the stocks tend to lead the complex. If the XOI turns higher today if crude falls then maybe the bottom is at hand. Stay tuned here.

Stocks are weak this morning on the futures side. The 10 year is at 4.66%. MLPS held up well yesterday as the rest of energy went down. We wait to see what the open brings us. No upgrades or downgrades on the list this morning at least so far.

Tuesday, January 09, 2007

Markwest Energy Partners ran up nearly 2 points at the close as today's big winner. Actually considering that the XOI closed near the low of the day...MLPS held up quite well with the index down less than half a point.

Overall considering what crude did today and the XOI down as it is...not bad.

OIL DIVES BELOW $55...NATURAL GAS HIGHER....ENERGY TRANSFER PARTNERS EARNINGS DUE OUT THIS MORNING!

Oil has decisively dropped below 55 dollars a barrel this morning and is sitting just above 54 even. Imagine we'll see a 53 handle at some point today. So look for some pressure at the open on energy stocks in general. Energy stock weakness doesn't always translate to MLP weakness but if a broad sell-off in big oil stocks developes it tends to spread to MLPS at some point.

Link on Yahoo indicates earnings will be out on Energy Transfer Partners (ETP) this morning. I'm not sure if this is correct. They use to post numbers around this time of the quarter but last quarter they reported in November i guess to account for their latest deal. If they do post i will link immediately. Meanwhile there are no other corporate developements and no upgrades or downgrades at least so far.

That oil chart above btw has broken down again so it looks like unless we get some sort of mega reversal later this morning or this afternoon 50 dollars is the next logically stopping point. Meanwhile we did see a bounce in MLP's yesterday off the support line. If MLPS can go their own way against other energy stocks it will say something about just how strong this group is relative not only to energy stocks but perhaps the entire market in general!

One last check of news and upgrades downgrades finds nothing so far. I will post when news hits.

Monday, January 08, 2007

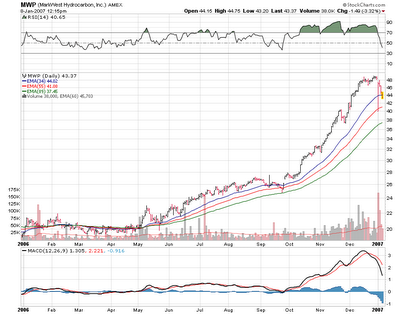

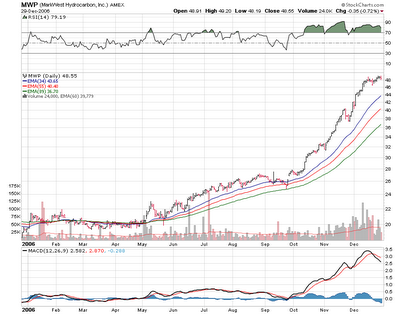

I began nibbling at MWP under 43 bucks...bought a small position and looking to add. I'm hoping to see this one cut its losses before the close. Lin Energy is laying just above 30 and so far is holding that level. I also added to Atlas Resources this morning for a trade into the 23-23.50 area.

Two stocks on the losers list today, Markwest (MWP) and Valero GP (VEH). Markwest is correcting off a terrific move. Those of you looking to buy might look to where the moving averages are settled for laddered buy points.

Valero GP (VEH) also looks like its correcting. It has already bounced off the 34 day moving average last week and might get back down there again. As long as MLPS remain in a bullish pattern i don't think this one should go much lower than the low 22 area.

Atlas Energy Resources (ATN)is approaching the 25th day of trading which is usually the point where all the brokerage houses fall all over themselves to recommend the stock. Usually the stock moves up ahead of these announcements so i look for a rally for this one to 23-23.50 very soon....all imho and no guarantees of course.

Crude Oil now pushing back to even on the day.

Right before electronic trading began last night the mid afternoon computer model package from the National Weather Service pretty much confirmed that colder weather is poised to spread across the US beginning late this week in the west and early next week in the east and that the cold weather could stay for awhile. Natural gas opened up 21 cents at 6pm last night and the rally is extending this morning. Crude Oil also opened higher by a few pennies and is now up nearly a dollar. So the turn that began Friday in big energy stocks should spread out today. Remember that even though most MLPS really are not dependant on the price of the commodities, investor perceptions often don't discriminate and when they are selling energy they are selling anything that has anything remotely to do with energy. That said i think we should have a good start this morning.

The daily chart shows the MLP index sitting right in the moving average support zone so this certainly could be a good place to bottom and begin a run back to new all time highs. I think the weekly chart supports the idea that we are not done with the upleg that began with the breakout late September 2006.

Meanwhile this morning there is no corporate news and nothing on the upgrade/downgrade list...at least so far. So letus begin trading this morning and i will revisit the situation after the open. Lin Energy should be coming out with distribution announcement soon if you follow past announcement dates. Remember 2.08 is a lock for this quarter and 2.28 annual for Q1.

Friday, January 05, 2007

Nat gas numbers are delayed for some wierd reason but we'll see if they provide a stablizing factor.

By the way i forgot to mention this morning thay there was no corporate news and no upgrades or downgrades. But after the open we did have news from Calumet Products Partners as they boost their distribution!

Nat gas numbers are out and the draw was basically in line. Crude and Nat gas are flat to slighty higher right now.

Though we'd do something i haven't done in a long time and that is to look at the actually energy commodities and their behavior. Firt off notice that on the 10 year vs crude chart the relationship now has inverted to a disinflation mode. Note that the rally in bonds began in July near the oil top at 80 dollars. And as oil has continued to sag rates have continued to fall. This is the reverse relationship of what was going on prior to the July 05 peak where both oil and bonds were moving together. So this chart is telling me that inflation is becoming less and less of an issue; certainly with respect to oil.

Meanwhile 10 year yields continue to fall as we wait for a clear bond breakout to 109-110 and beyond. So at least with respect to yields...MLPS still have a favorable rate picture.

Meanwhile did you ever see a chart so ugly looking as the nat gas chart? No sign of a bottom here although clearly we did just make another leg down and maybe 6 dolllars is a good place for a floor.

And of course this equally hideous looking chart in Crude Oil which as we speak is seeing oil now with a 54 handle and at 18 month lows.

So at least at the start of trading this morning we're looking at more pressure on big energy stocks especially with a major brokerage downgrade on Exxon Mobil...add to that general pressure on stocks in general after a big Japan selloff last night and you will see some opening pressure on MLPS at least at the start. Two things to look for will be whether big energy stocks will put a temporary bottom and rally against falling crude prices. The stocks usually turn before the commodity so that will be a clue. Exxon (XOM) or the XOI are the best proxies to watch here. Secondly will be the bond reaction to the employment numbers at 8:30am. If yields fall that should put a floor under MLPS today. Also the many downgrades of tech stocks could see money move to more defensive positions and thats good for us.

Meanwhile Lin Energy (LINE) has pulled back into support and sits just above the moving average support lines. This stock will see its distribution go to at least 2.08 annual and that announcement comes any day. So its priced to yield 6.90% so in my view there is strong yield support. And it has pre-announced for April Q1 at 2.28 or priced to yield 7.6%. Ultimately i think this one still heads for the middle 30s in the next few months.

Meanwhile Valero Holdings (VEH) has been straight up since Valero (VLO) finally got rid of its stake of shares. And yesterday the stock seemed to try and correct all in one day as it dropped right to the 34 day moving average before closing a point above it. If the group selloff continues the support lines as always are good places to go shopping for shares.

So lots to ponder this morning as we wait for the open.

Thursday, January 04, 2007

Once this energy pressure comes off...i think MLPS should head back to new highs as 10 year rates hold or fall from here. But corrections are always difficult to get through.

Good Thursday morning to all after a first day of trading where most things energy were chucked out the window. MLPS while down did hold up well in the face of the energy selloff which will probably continue to some degree at the open today.

In the news this morning Natural Resource Partners closes its deal with Cline Energy and gets the rights to buy another 3 billion tons in coal reserves. The company also issues 3 million shares (non dilutive) and half a million class B shares to Cline. No other news on the corporate side this morning and so far no upgrades or downgrades.

Crude oil continues to take gas as it is down another 60 cents this morning. Natural gas has found a floor at least for now and is higher. It sold off yesterday but not as hard as crude which dropped nearly 3 bucks! The 10 year is down one basis point this morning at 4.65%.

There really isn't too much else going on this morning. So far my speculative coal gamble is a bust as the coal stocks got hit very hard but i took an options dice roll with a limited amount of risk involved...and it ain't over until the 3rd Friday in January.

Wednesday, January 03, 2007

Ferrellgas (FGP) buys Puget Sound Propane announced before the close. On the lookout for after market news but none so far. Energy Transfer Partners (ETE) and Energy Transfer Equity (ETE) both went ex-distribution today.

Meanwhile on the upside Calumet (CLMT) is up and we have fractional gains in Crosstex (XTXI) US Shipping (USS) Holly Partners (HEP) and a few others.

And that search is not necessarily going to be easy given the stellar results of last quarter. The MLP index went from 257.72 on the close of trading at 9/29 to 282.93 on 12/29 for a 25.21 gain or 10% plus a healthy October distribution.

So where do we go from here? Well i have argued that nothing much has changed. The same factors of stable energy prices...a stable to falling 10 year...and a bullmove in the overall market should continue to provide a tail wind for MLPS. Add to that the prospect for more distribution increases this quarter means more yield compression. The problem will be what to buy since many of these have had big moves. Some ideas to follow.

Lets return to this morning for just a minute here. We do have a large downgrade for Markwest Hydrocarbon as Lehman Brothers goes from Overweight to underweight.

This was one of my picks last quarter when it was 28 on 9/29 so the gain here was huge. The chart would suggest a pullback of sorts here at least to the moving averages so a quick drop to 44 might be a place to start nibbling since i think this one has more upside down the road. No other news and no other upgrades or downgrades so far.

One MLP that has not moved in the last quarter is Alliance Resource Partners (ARLP) and Alliance Holdings (AHGP) which is the general partner. These 2 stocks have been weak mainly because pull up any coal stock and they've gone nowhere but down in the past several months following nat gas.

I've been bringing up these 2 lately and i think their moves will hinge on a turn in the weather. And that turn in my humble meteorological opinion is coming.

Now while you would look at this forecast and say that it still shows warm in the east and cold in the west and that's true but remember this is over a 6 day period from Jan 10-16 which will average out to this forecast but the beginning of the period will be much warmer and the cold air will be spreading eastward bringing near or below normal temps for the east and midwest just beyond this forecast period. The models have been consistent in showing a winter pattern finally getting established across the US. which will have impact on the second half of this month.

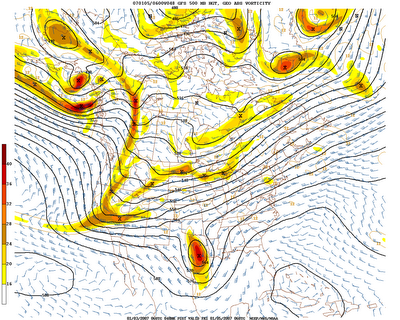

Now for a little meteorology lesson. The above map is pretty much what the jet stream pattern across the US looks like today. Basically you could read it like a west to east road map. Assuming nothing changes you would just follow the lines to show where your air is coming from. In this instance the pacific is the main feeder of air and not the arctic. Winds are blowing across a relatively warm pacific across California and the west and straight across the us to the east coast....result is no air flowing from Canada or the Arctic and you get above normal temperatures certainly everywhere east of the rockies.

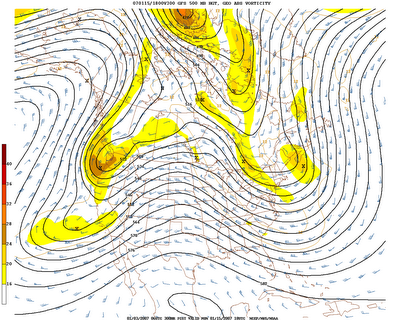

Now in this view which is a forecast for the jet stream late next week notice the huge difference. The Air in the east is getting its flow now from Canada and their is actually some feed from Northern Canada. Assuming a static atmosphere this results in at least normal temperatures in the midwest and east and below normal temperatures are even likely. The big question is if this is a temporary change that lasts a few days or a few weeks and then reverts back to the pattern of late October to early January which has been very warm everywhere. Right now my bet is that once the pattern makes the change its going to stick around at least for a few weeks. I will be looking for clues to see if this has longer term ramifications. All of this will at least have some impact on the energy markets especially nat gas. And if nat gas goes up coal will be pushed higher as well.

Also on the agenda this morning will be how MLPS react now that we're in a new tax year. This may provide opportunites in Lin Energy (LINE) and Regency Partners (RGNC) where sellers could be dumping shares on these winners in a new tax year. If that happens it may be a chance to get in...especially LINE which if it drops near or under 30 again...one could back the truck up.

So lots to ponder here as the open approaches.

Tuesday, January 02, 2007

An early post as we head into opening day Wednesday and bear in mind that winter time may be poised to make a return to the USA beginning next week and then spreading everywhere in 2 weeks. If this pattern change is confirmed look for energy markets but especially nat gas to rally sharply. More in this in the morning when i will disect the weather patterns and a few other things.

I am starting off 2007 being sued by HSBC Bancorp for unpaid loans.(i was served last friday dec 29th at 4pm!) It was for a business i used to own a few years ago which collapsed after i sold my share of it. The bank never took me off the accounts and they are coming after me for about 75 grand. Thankfully i have paper work (which they lost btw) but i have had to deal with abuse, brickwalls, collectors and other assholes. Moral of this story is...don't bank at HSBC and always keep a good lawyer handy!

I hope everyone is over the Christmas- New Year's stretch as we finally begin 2007 trading. S&P futures are up nearly 9 points as Europe as strong today. Oil is down a bit and Nat gas which was down hard earlier has rallied back to unchanged. If the meterological guidance for the next several weeks continues the trends of the last few days you will start hearing weather related rallies in the energy markets.